Lululemon Stock Drops 16% Despite Earnings Beat, as Guidance Is Lighter Than Wall Street Expected

The activewear company's revenue growth in its core Americas market is slowing, but growth remains strong in its international business, especially in China.

The activewear company's revenue growth in its core Americas market is slowing, but growth remains strong in its international business, especially in China.

Here's Why lululemon (LULU) is Poised for Earnings Beat in Q4

3 Key Things From Lululemon's Earnings Call That Investors Should Know

LULU Stock Price, lululemon athletica inc. Stock Quote (U.S.: Nasdaq)

Lululemon Stock Drops 16% Despite Earnings Beat, as Guidance Is Lighter Than Wall Street Expected

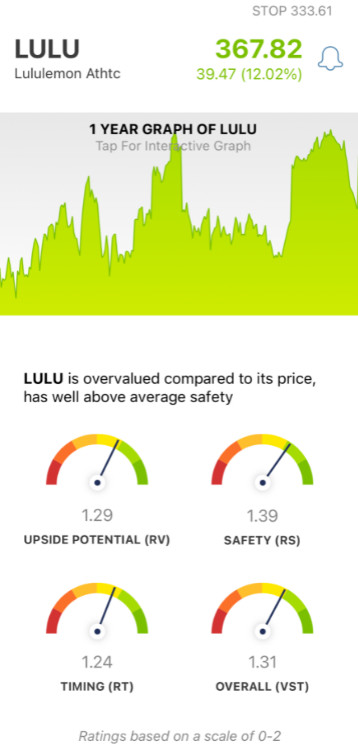

Lululemon Stock, Buying Opportunity on Lowered Guidance?

Lululemon Stock Dives After Lowering Profit Margin Expectations For Q4 2022

Lululemon (LULU) Stock Drops as Outlook Falls Short of Wall Street Estimate - Bloomberg

Here's Why Investors Should Retain Abbott (ABT) Stock Now

1 Magnificent Growth Stock Down 21% to Buy Right Now

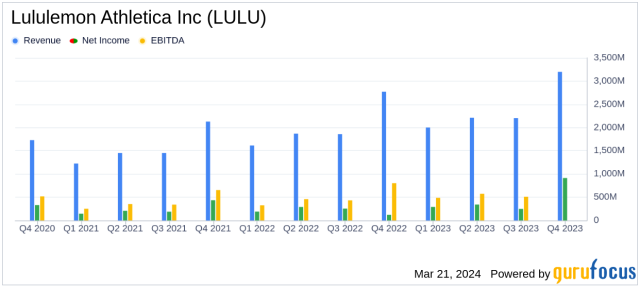

Lululemon Athletica Inc (LULU) Reports Robust Fiscal 2023 Earnings With Significant Revenue and

Lululemon Boosts Guidance and Scores 13% Gain on Earnings: 3 Other Reasons We Love This Stock - VectorVest

Lululemon stock surges as much as 16% as it posts stronger outlook, pivots from Mirror

Lululemon Athletica (LULU-Q) Stock Price and News - The Globe and Mail

Stock Market News for Mar 21, 2024