Australian Government Bonds - Bond Adviser

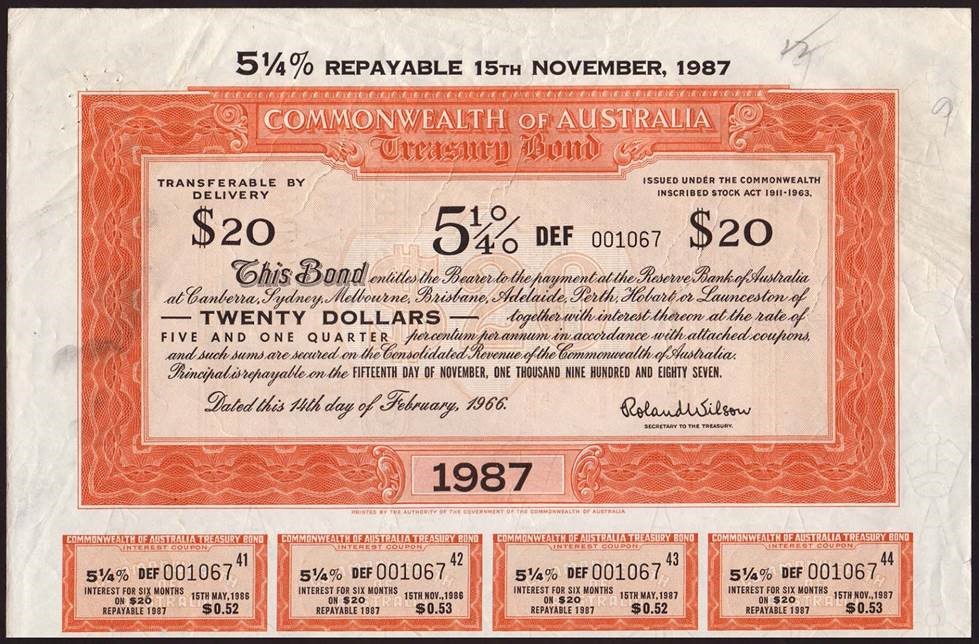

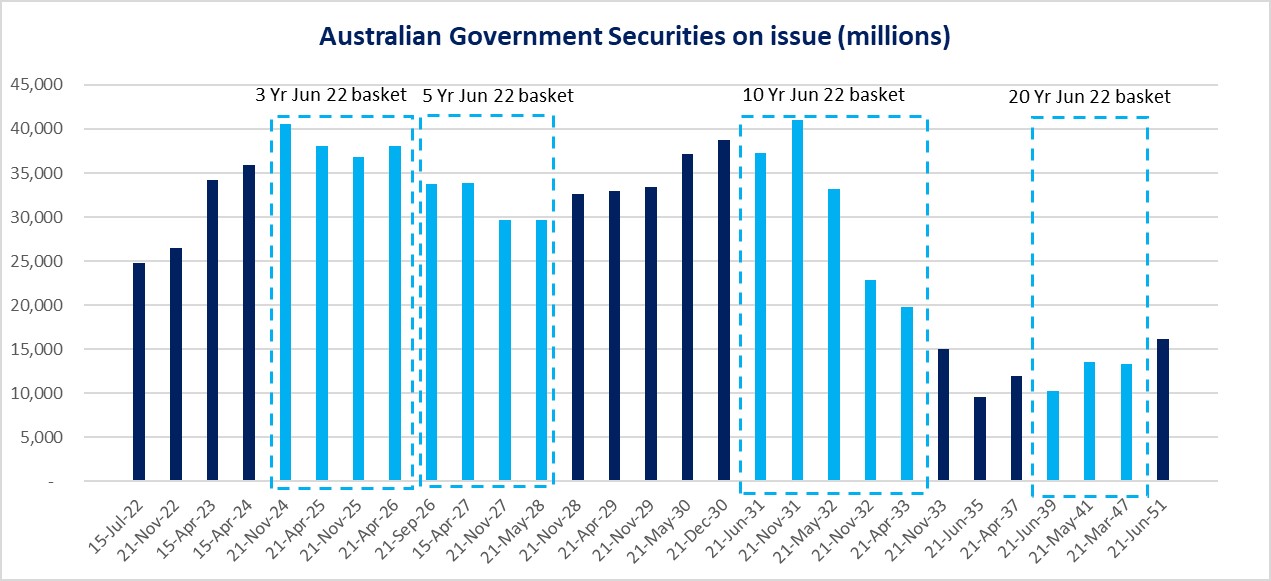

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

Exchange-traded Australian Government Bonds

/wp-content/uploads/2023/07/30-Year

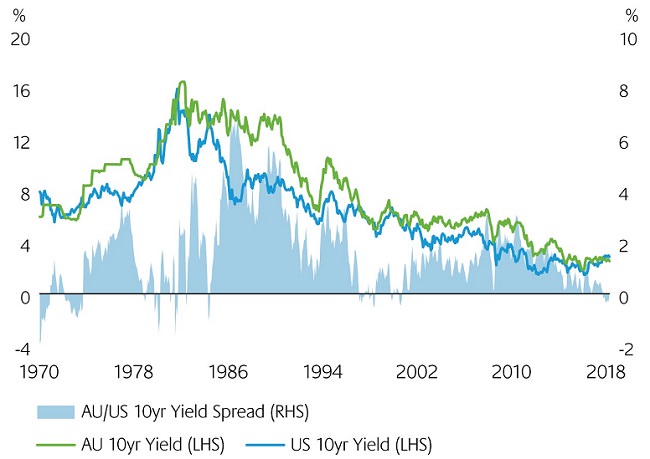

The impact of negative Australian versus US rate spreads

What is a bond?

:max_bytes(150000):strip_icc()/full-frame-of-us-patriot-treasury-bonds-647036948-5a936b10eb97de003765a6dc.jpg)

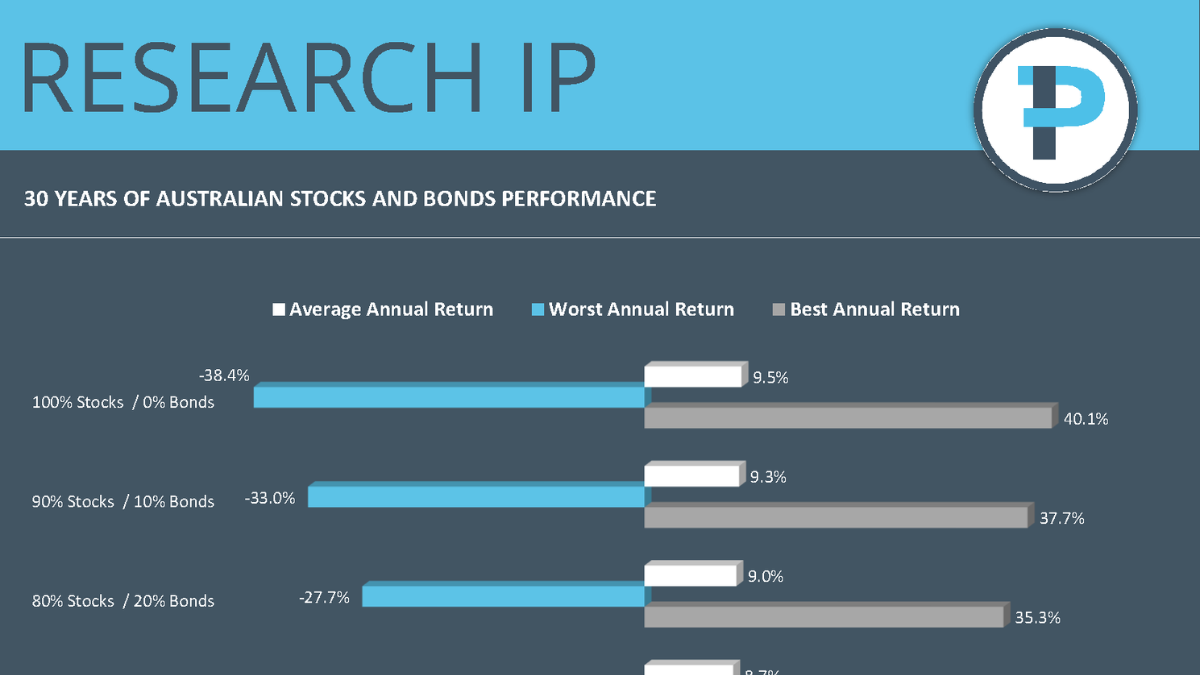

How to Build Your Own Bond Portfolio

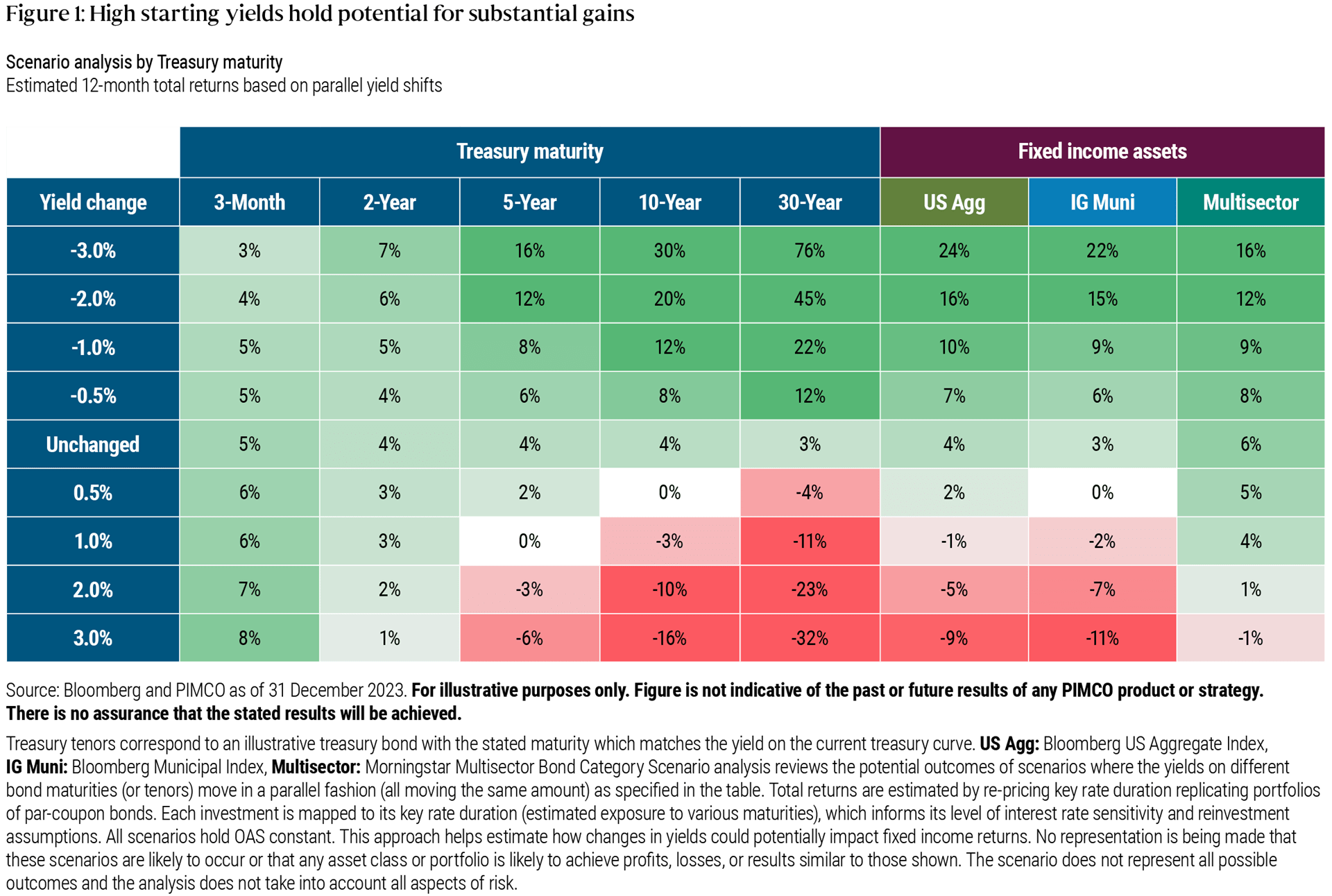

Shocking Bonds: Evaluating Advisor Fixed Income Portfolios as the Fed Enters Its Next Phase

THE D'ALLAIRD GROUP: D'Allaird, Pedraza, Devlin, Marotta, Financial Advisors in Wayne, PA 19087

How to invest in bonds & fixed income, ft. Cameron Gleeson

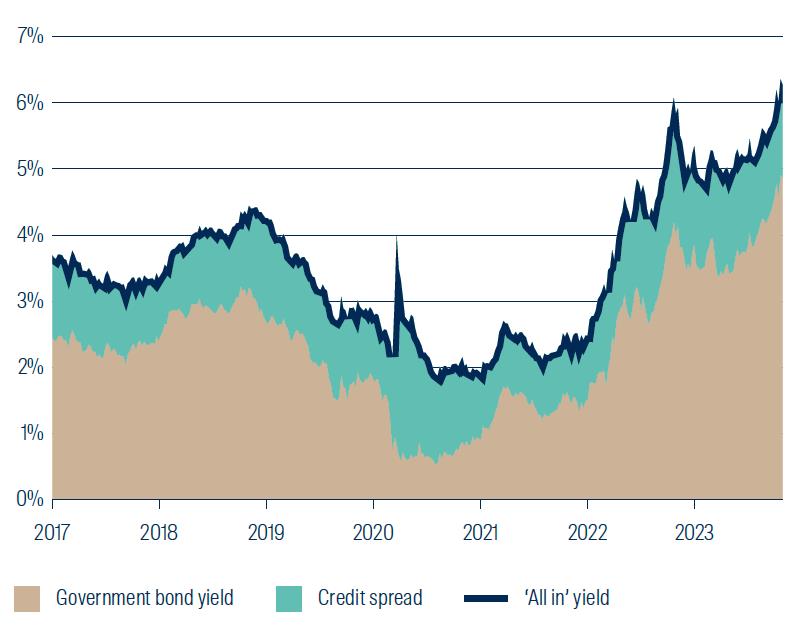

Global Credit: An Introduction

What's unique about Australian bond futures?

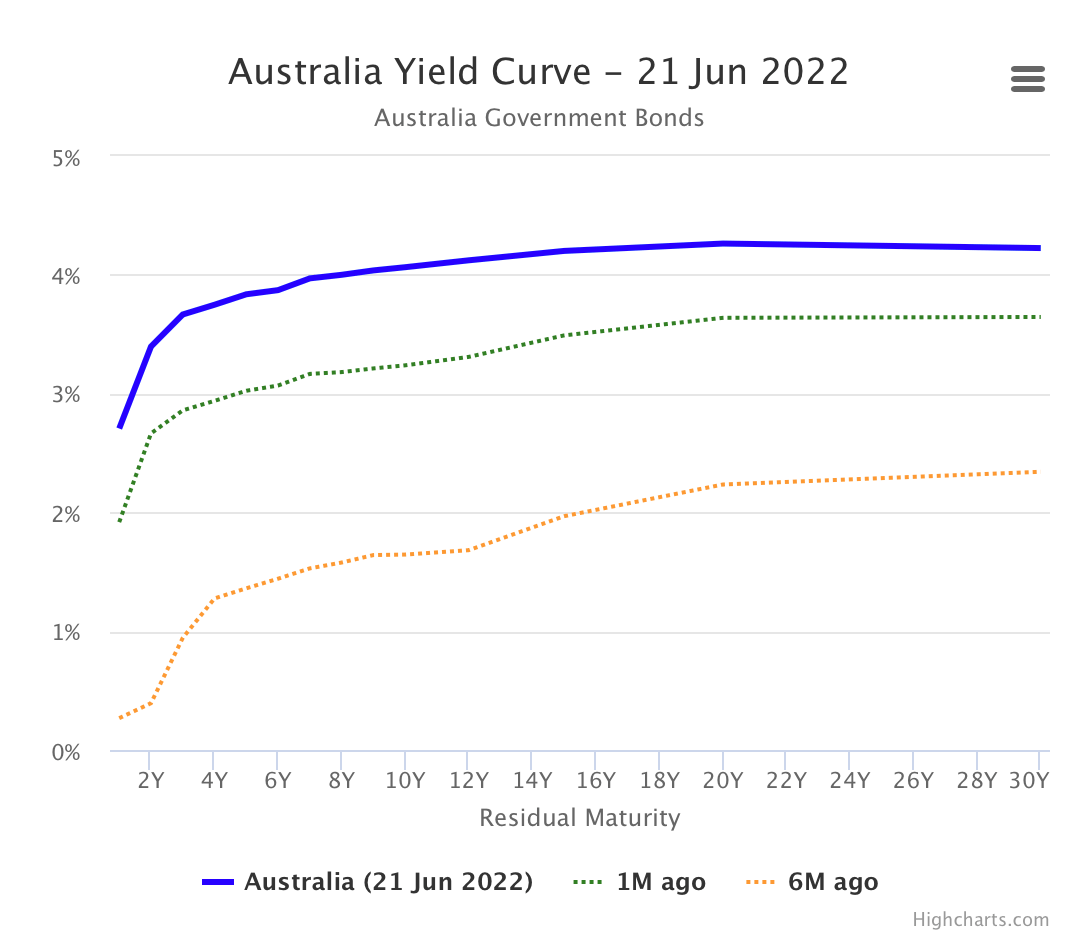

What's happened to the 10-Year Government Bond Yield? - Bond Adviser

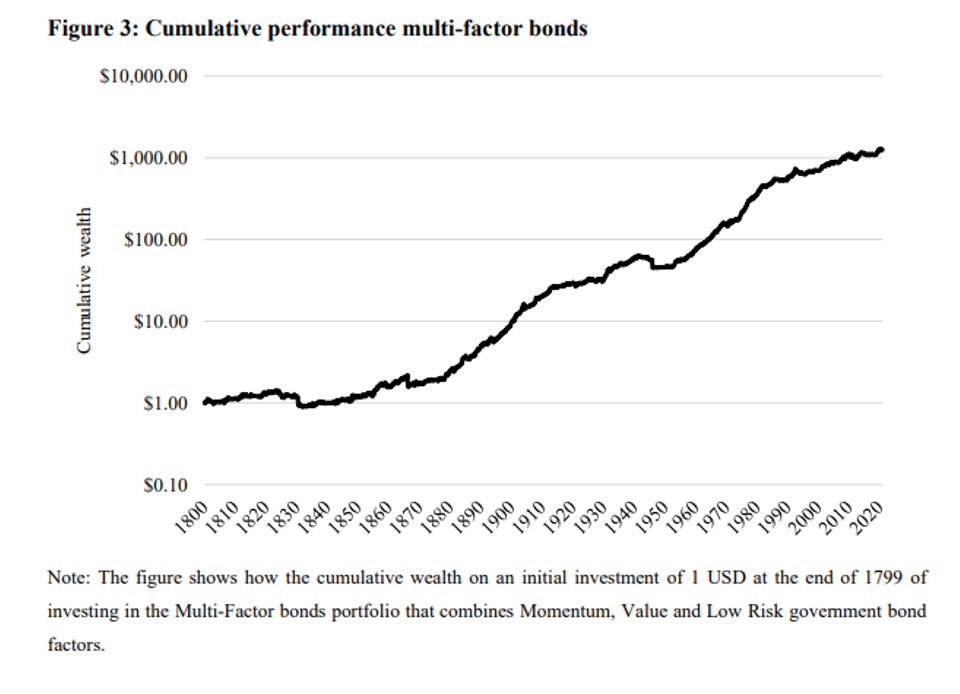

Factor Investing in Sovereign Bond Markets

How Do I Trade Bonds? Interactive Brokers LLC