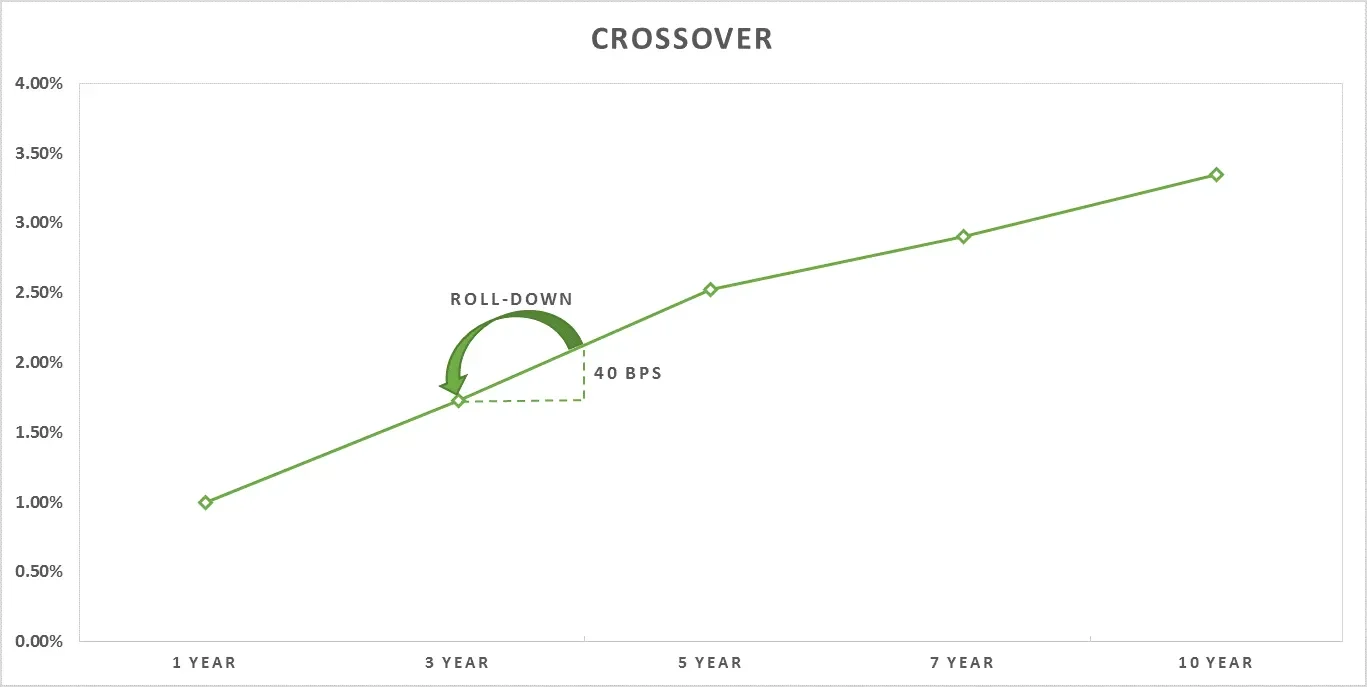

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

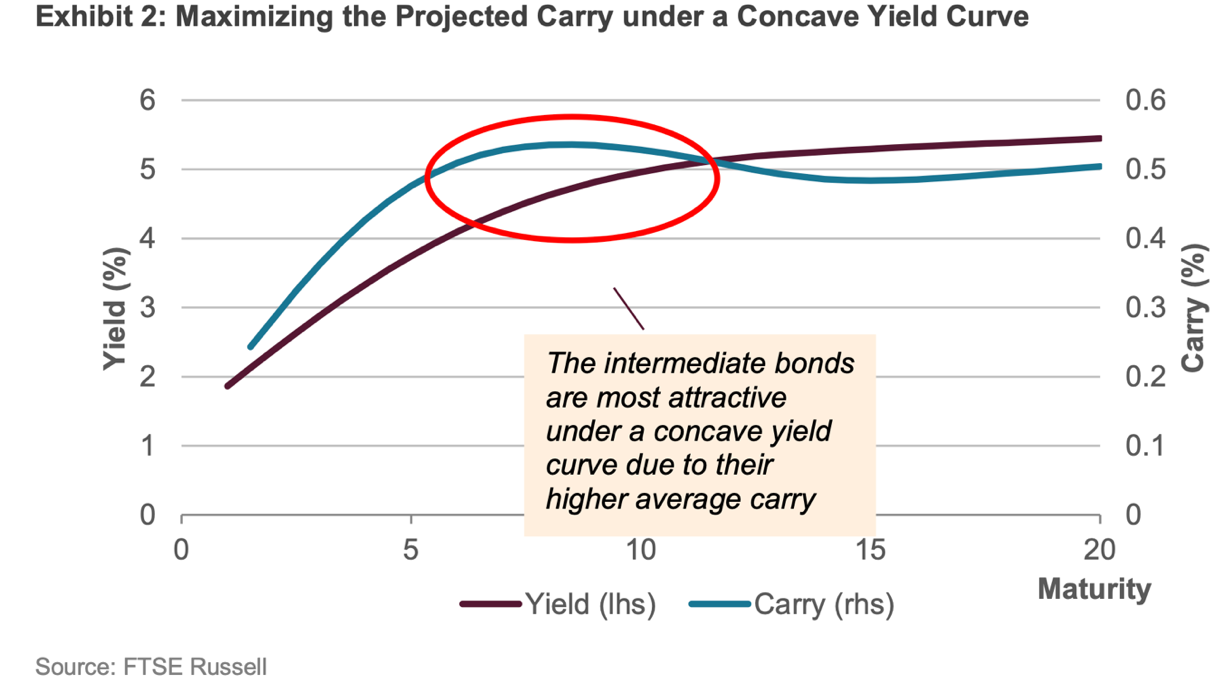

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

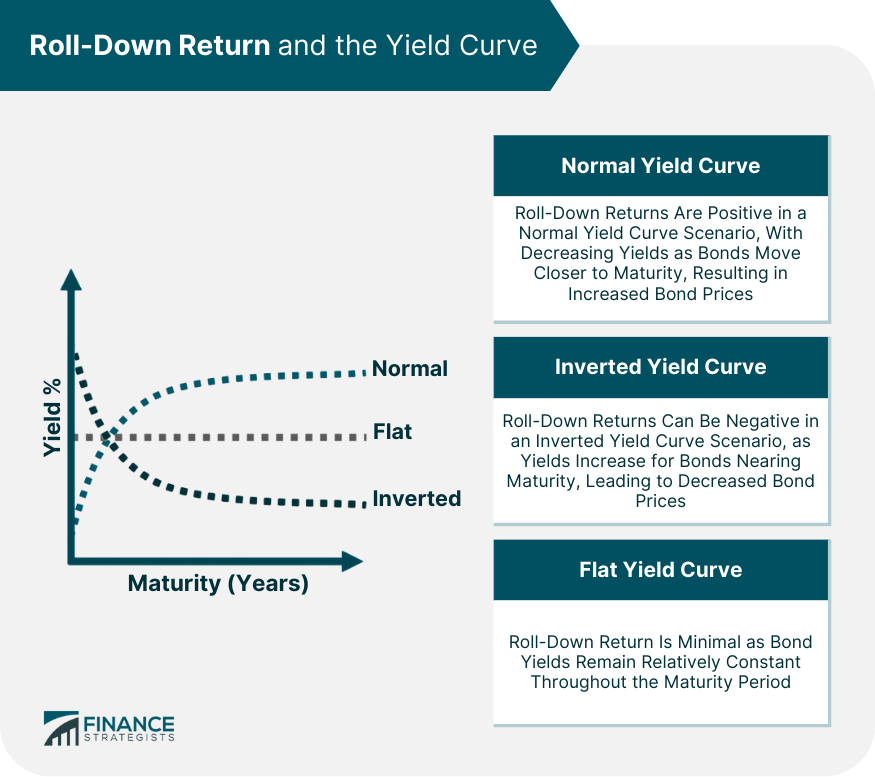

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Roll Down explained TwentyFour Asset Management

Applied Sciences, Free Full-Text

Riding the yield curve – BSIC Bocconi Students Investment Club

Zero-Coupon Bond Formula + Calculator

Roll-Down Return Definition, Elements, Calculation, Applications

Can you make money in fixed income in the age of The Zero?

Roll down yield on upwards sloping YC : r/CFA

Materials, Free Full-Text

:max_bytes(150000):strip_icc()/dotdash_Final_Contango_vs_Normal_Backwardation_Whats_the_Difference_Oct_2020-01-10fe64ec4d4542c5bf857fa8c10c96b5.jpg)

Contango vs. Normal Backwardation: What's the Difference?

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Brazilian Yield Curve