Low-Income Housing Tax Credit Could Do More to Expand Opportunity

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

Revisiting the economic impact of low-income housing tax credits in Georgia

Low-Income Housing Tax Credits: Why They Matter, How They Work and How They Could Change - Zillow Research

Housing and Health Partners Can Work Together to Close the Housing Affordability Gap

Making Sense of the Low-Income Housing Tax Credit for Investors

Rep. Morgan McGarvey on X: As the number of families experiencing homelessness rises nationwide, we have to make sure we're doing all we can to safeguard affordable housing for those who need

The New Social Housing - Harvard Design Magazine

Series: Low Income Housing Tax Credit Spending Difficult To Track, Measure

How the Federal Tax Code Can Better Advance Racial Equity

Tax credits: Utilizing Incentives to Improve After Tax Return on Assets - FasterCapital

Murphy Administration Awards Over $22M In Federal Tax Credits to Expand Affordable Housing for Families, Seniors, Special Needs Residents — NCSHA

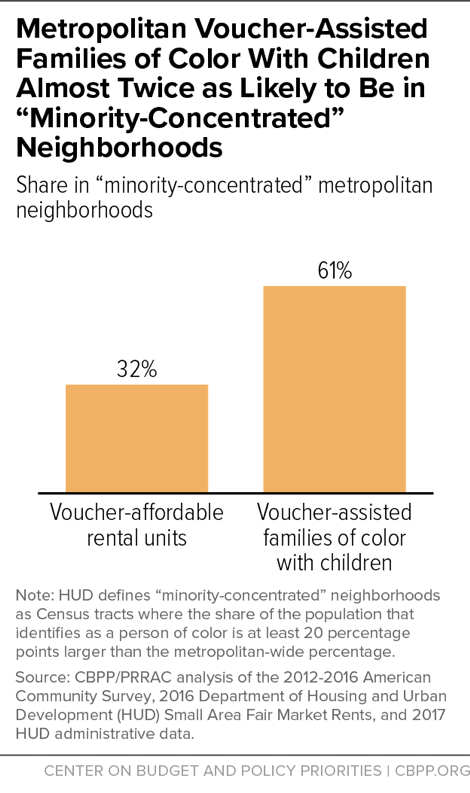

Where Families With Children Use Housing Vouchers

Butler Snow 2023 Texas Legislative Updates to Low Income Housing Tax Credit Developments

Low-Income Housing Tax Credit Guide

The New Social Housing - Harvard Design Magazine

Congress May Expand The Low-Income Housing Tax Credit. But Why?