What Are Fringe Benefits? How They Work and Types

:max_bytes(150000):strip_icc()/fringe-benefits.asp-final-d5218f87c38c43ad9189b81be15a83ce.png)

Description

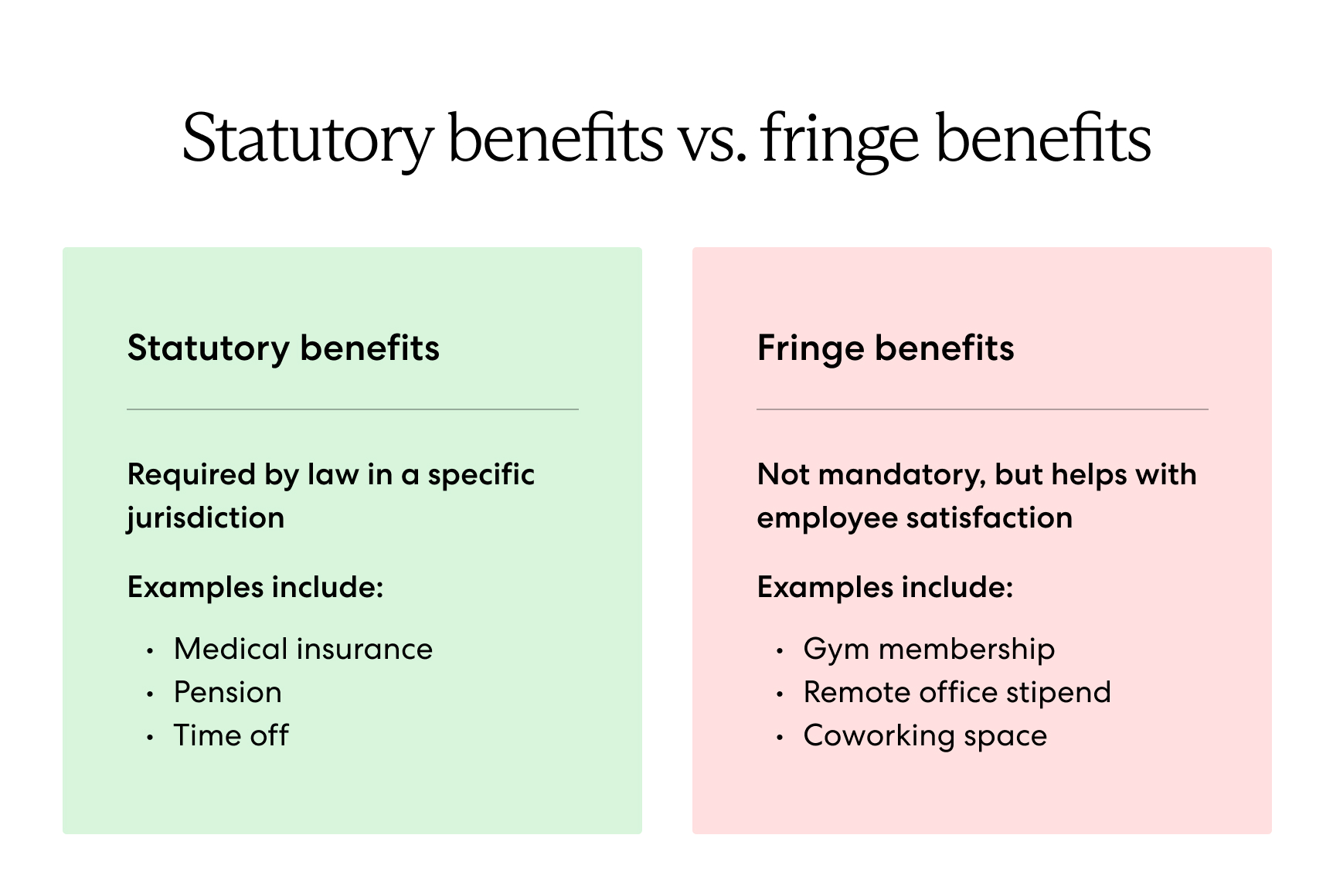

Fringe benefits may be taxable as income and in addition to employee compensation, such as paid time off or a company car.

What are fringe benefits?

:max_bytes(150000):strip_icc()/hiring-2d149ca30bd84ba398644a7b9631df59.jpeg)

Are Cafeteria Plans Subject to ERISA, FICA, or FUTA?

What Are Fringe Benefits? Definition and Examples

image.slidesharecdn.com/hrppt-150311174546-convers

:max_bytes(150000):strip_icc()/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

Wellness Program: Meaning, Criticisms, Example

Peter Craig, CFP® on LinkedIn: Money

Types of Employee Benefits: 12 Benefits HR Should Know - AIHR

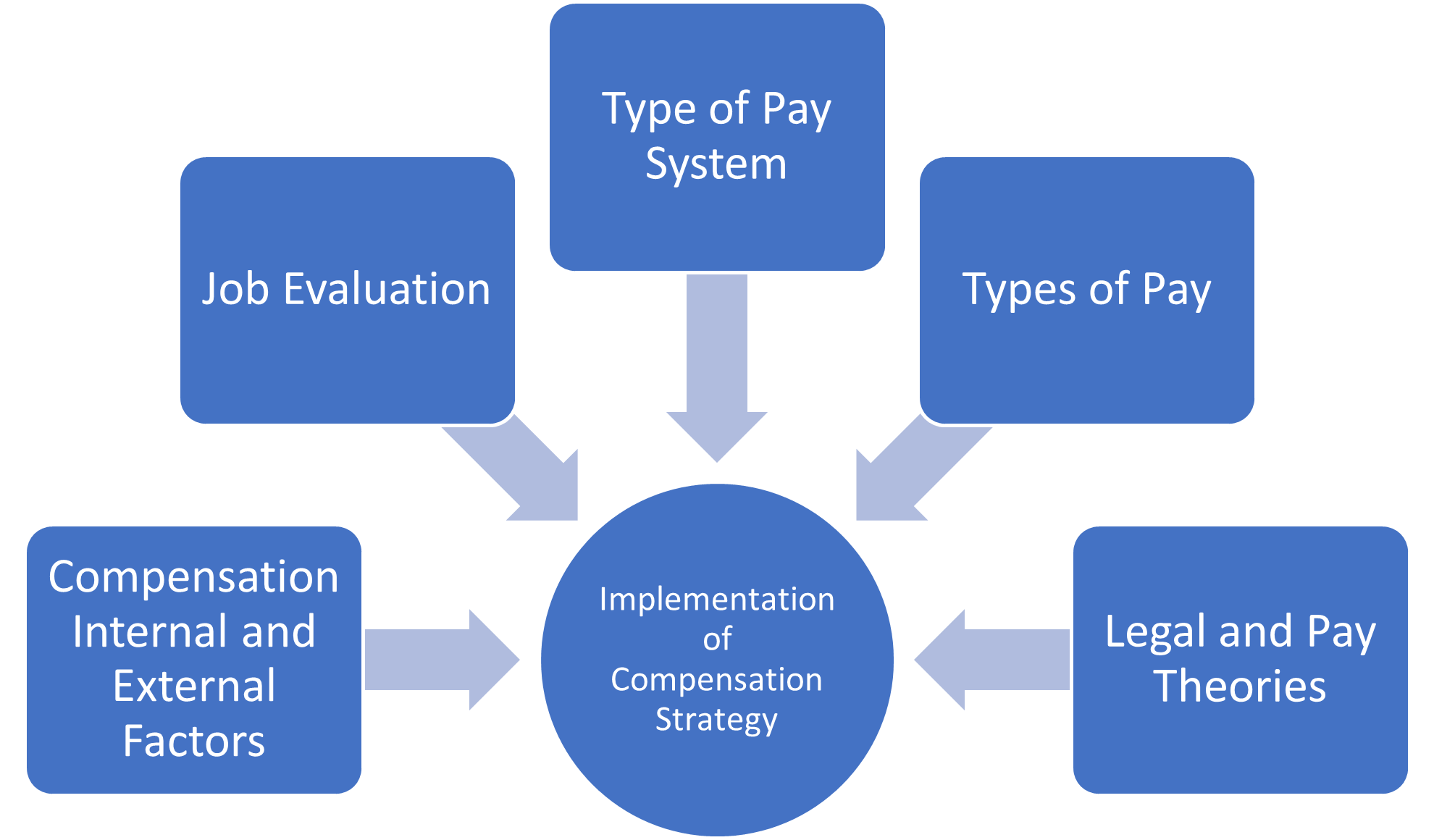

Types of Pay Systems – Human Resources Management – 2nd Ontario Edition

:max_bytes(150000):strip_icc()/GettyImages-1718650567-d5b5e5e457e84340a04ef8a21dc277f8.jpg)

Salaries & Compensation

Related products

$ 16.99USD

Score 4.9(316)

In stock

Continue to book

$ 16.99USD

Score 4.9(316)

In stock

Continue to book

©2018-2024, farmersprotest.de, Inc. or its affiliates

/www.astoria-activewear.com%2Fproducts%2Fastoria-luxe-metallic-series-sports-bra-mauve%2F1625170392%2F2W2A9587_95eecece-3b3e-469d-aa85-b7962c0812aa.jpg)