HSA-Eligible High-Deductible Health Plans - University of Michigan

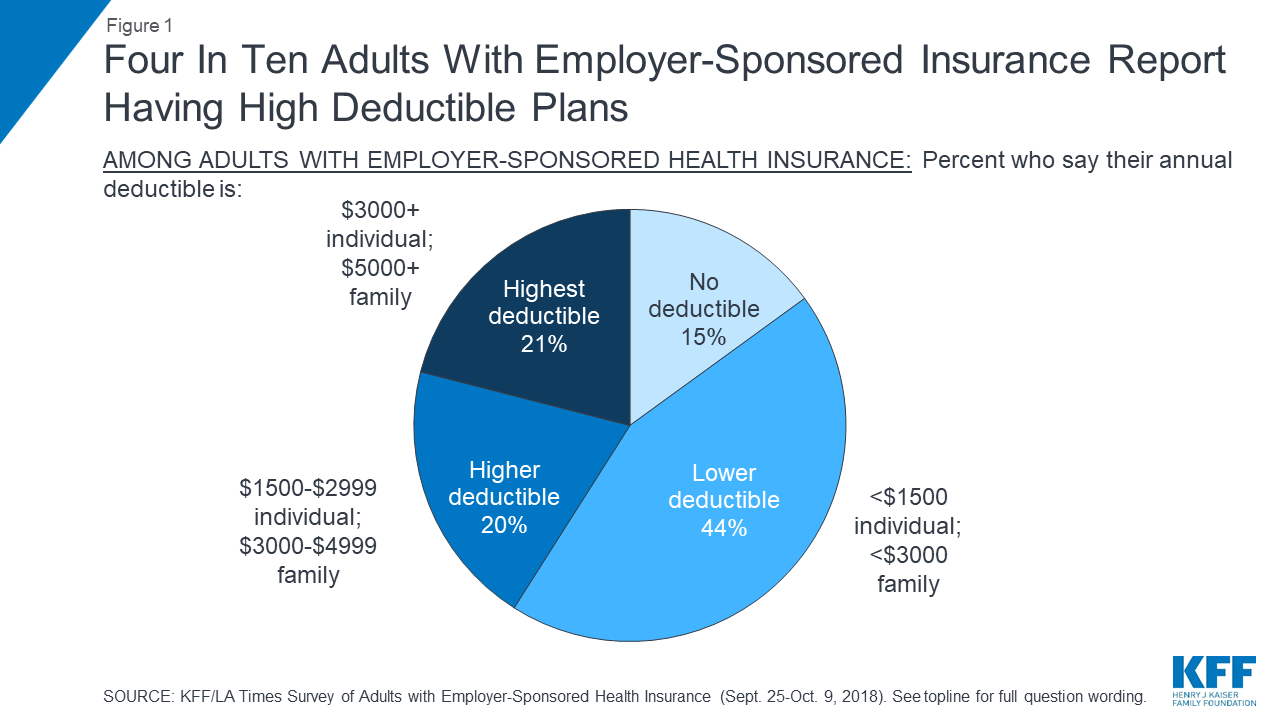

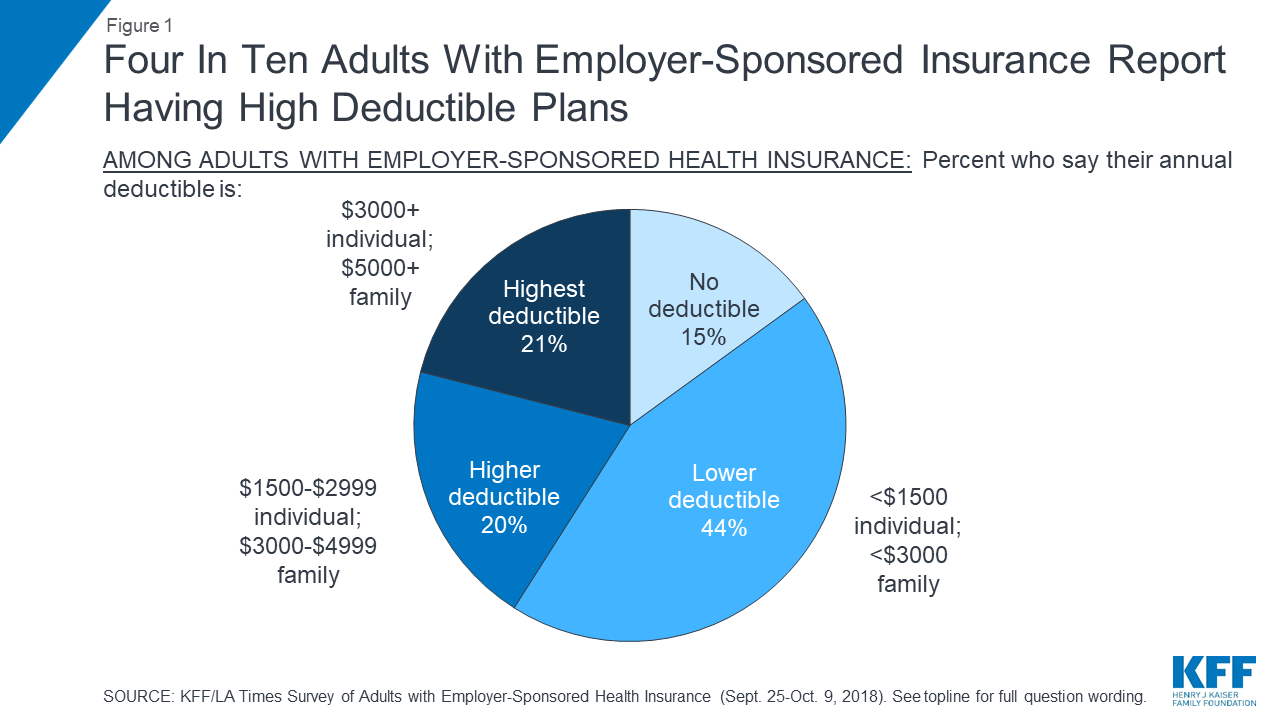

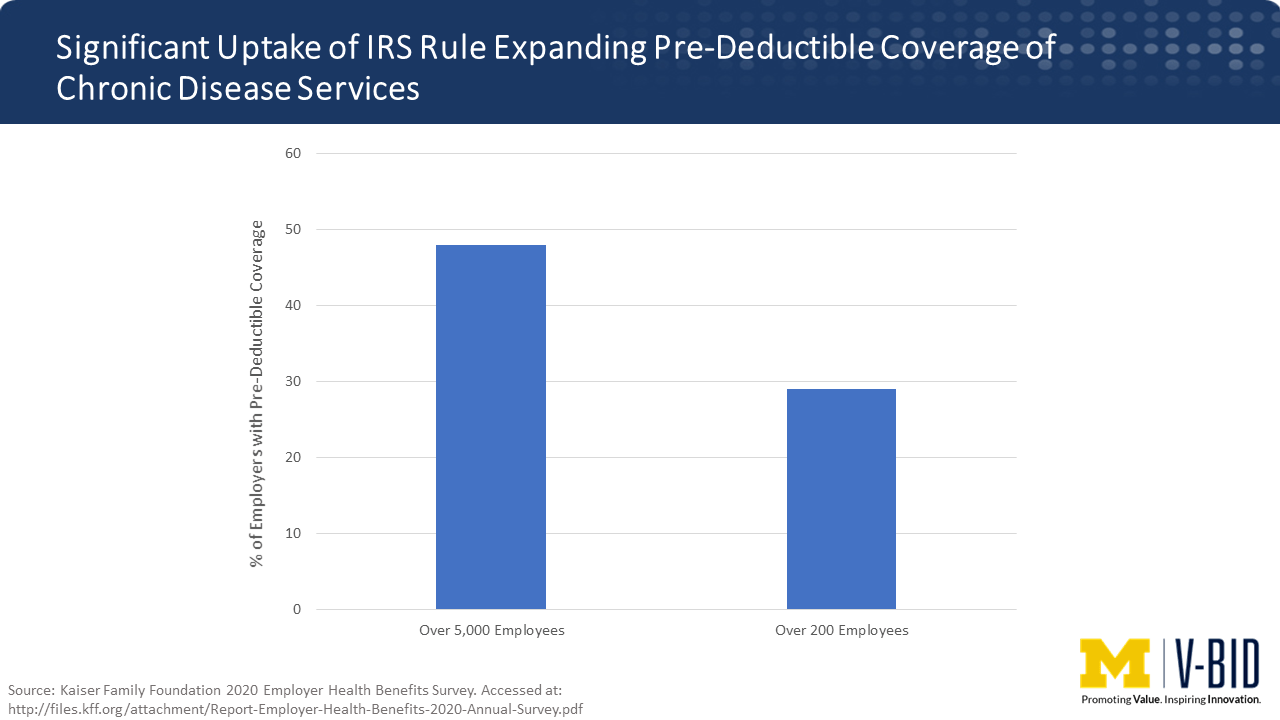

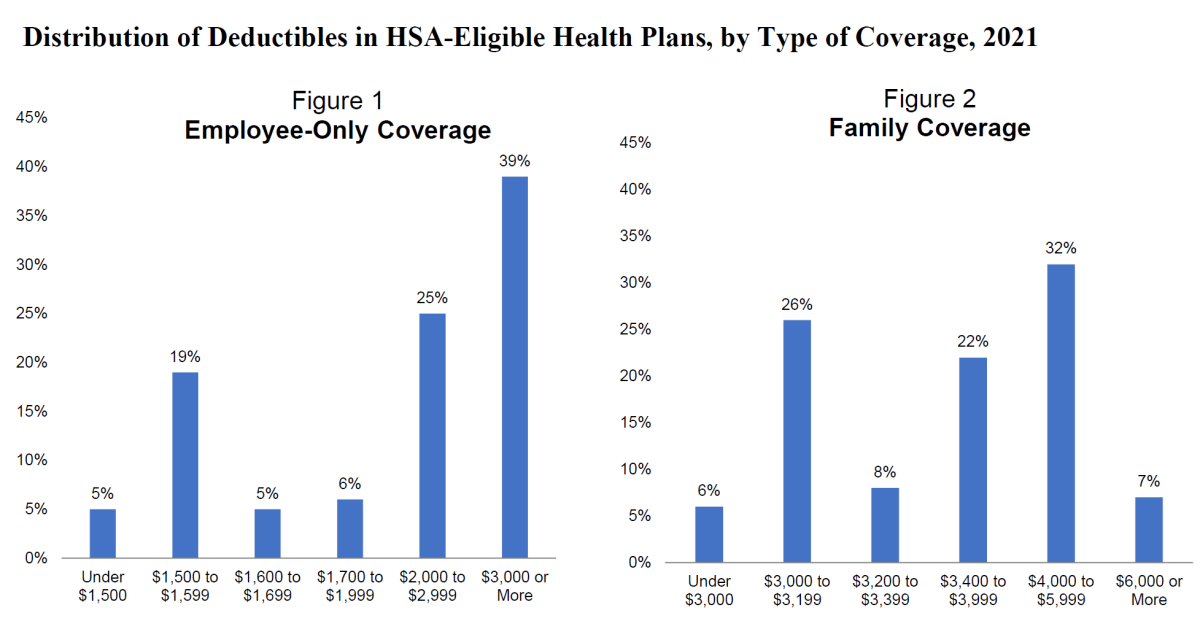

In April 2021, the Chronic Disease Management Act of 2021 (CDMA) was introduced in the United States Senate (S. 1424) and House of Representatives (HR. 3563). This bipartisan bill builds upon previous versions of CDMA and follows a guidance issued by the US Department of Treasury in 2019 to further increase the flexibility of HSA-HDHPs to cover chronic disease services on pre-deductible basis. The 2020 Kaiser Family Foundation Survey reported that of employers offering an HSA-qualified health plan, 48% of employers with over 5000 employees and 29% of employers with over 200 employees reported implementing a benefit design that expanded pre-deductible coverage. Smarter Deductibles, Better Value: Expanding Coverage in HSA-HDHPs High-deductible health plans paired with a tax-free health savings account (HSA-HDHP) represent a growing percentage of plans offered on the individual and group market. HDHPs have defined minimum deductibles and maximum out-of-pocket limits. As of 2017, 43% […]

W&M approves HSA enhancements - Don't Mess With Taxes

Section 8: High-Deductible Health Plans with Savings Option - 10240

Trump Plan Might Cut Expenses For Some Insured Patients With Chronic Needs - California Healthline

Academics, industry groups lobby for more flexible high-deductible plans, EBA

Threat of Social Security Depletion Emphasizes Importance of HSAs, Proponents Say

Tax Rule Limits Care For Chronic Ills Under High-Deductible Health Plans : Shots - Health News : NPR

HSA-Eligible High-Deductible Health Plans - University of Michigan V-BID Center

Many medical 'rainy day' accounts aren't getting opened or filled, study finds

HSA-Eligible Health Plan Deductibles to Increase in 2024 - Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More

HSA-HDHP V-BID TV - University of Michigan V-BID Center

Introduction to Health Savings Accounts (HSA)

Retirement FAQ's - Benefits - Grand Valley State University

Introduction to Health Savings Accounts (HSA)