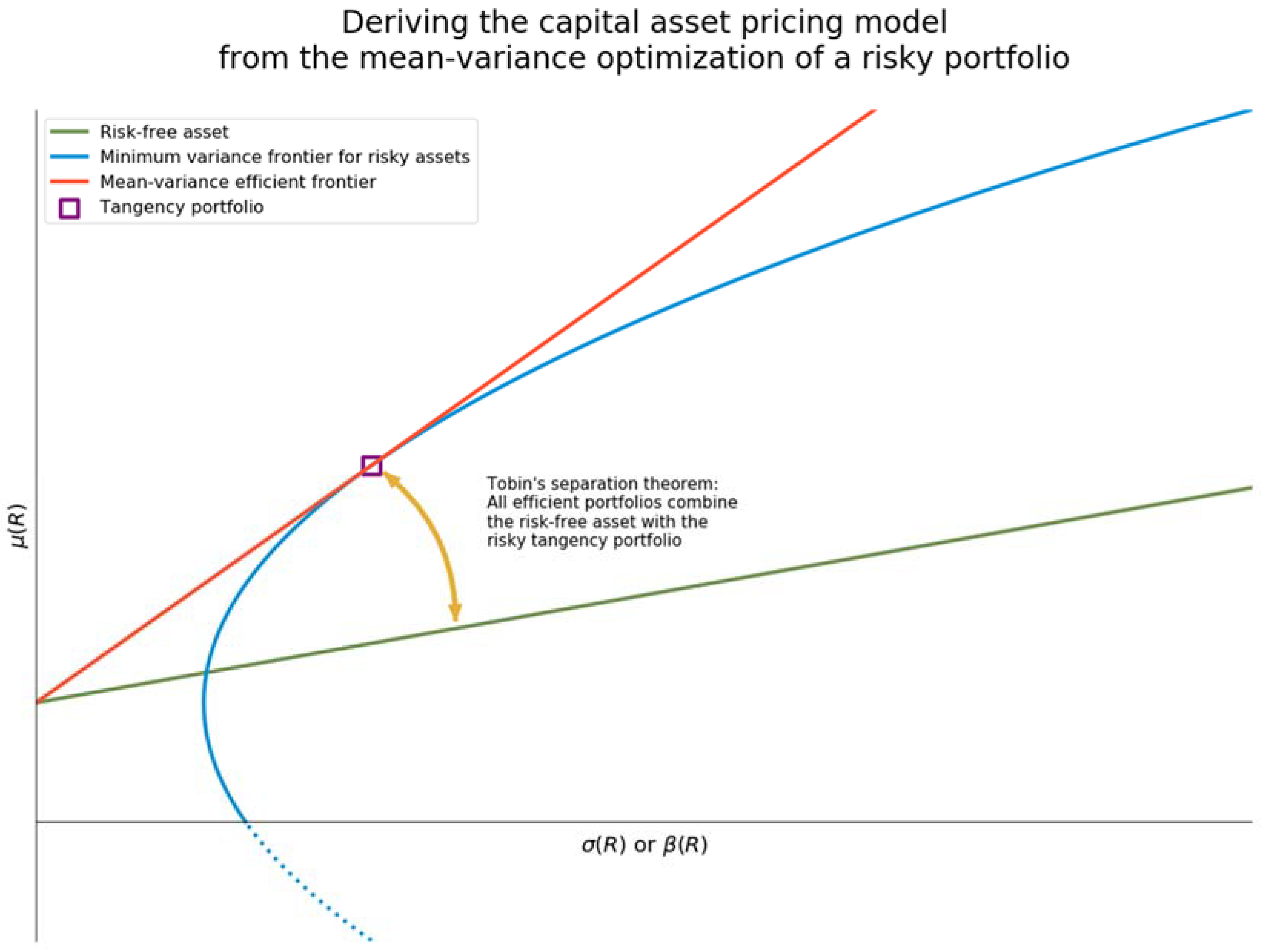

A Bond Convexity Primer CFA Institute Enterprising Investor

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

On The Finer Details of Carry and Roll-Down Strategies - Moorgate

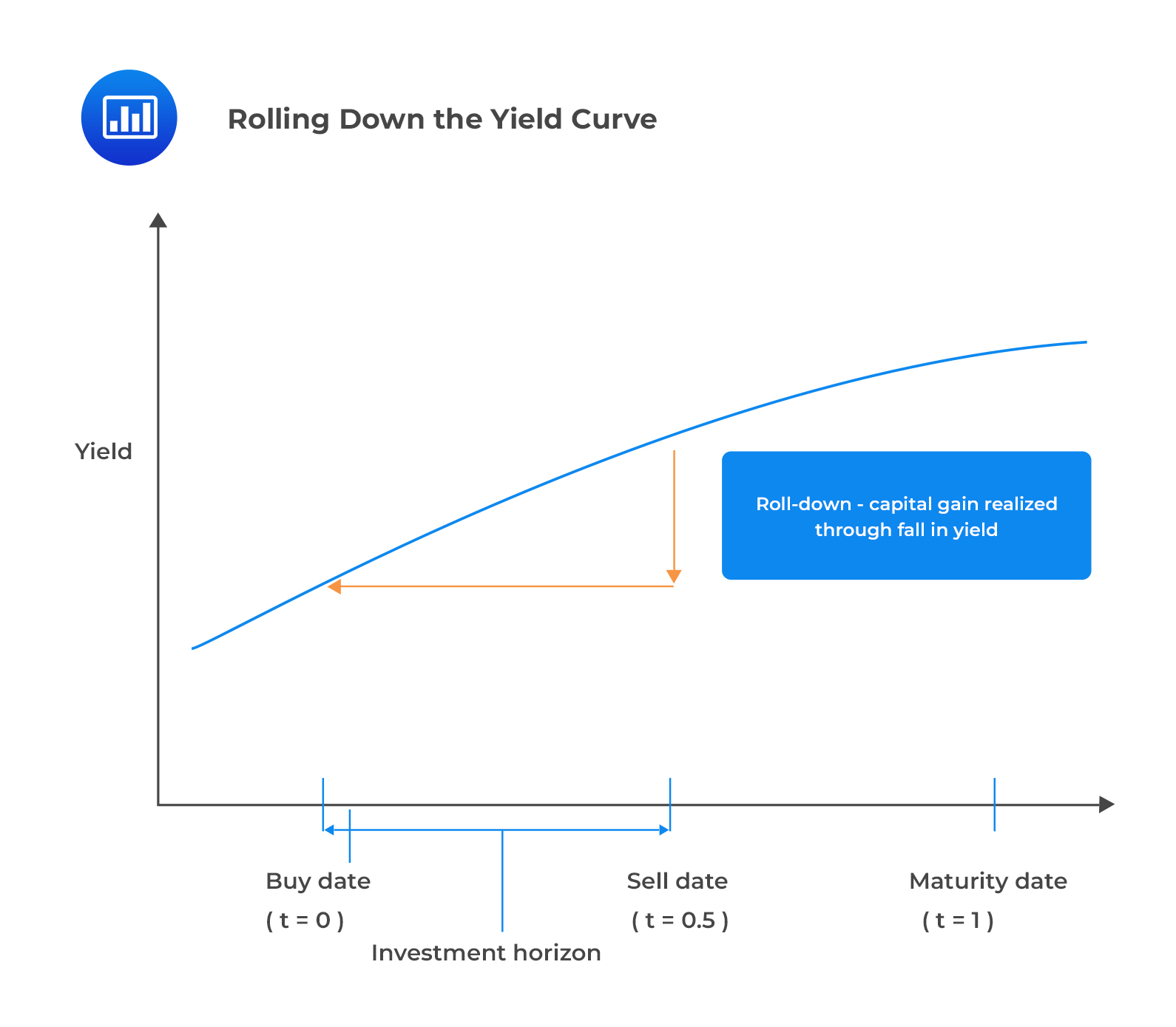

Riding the Yield Curve - CFA, FRM, and Actuarial Exams Study Notes

Encyclopedia, Free Full-Text

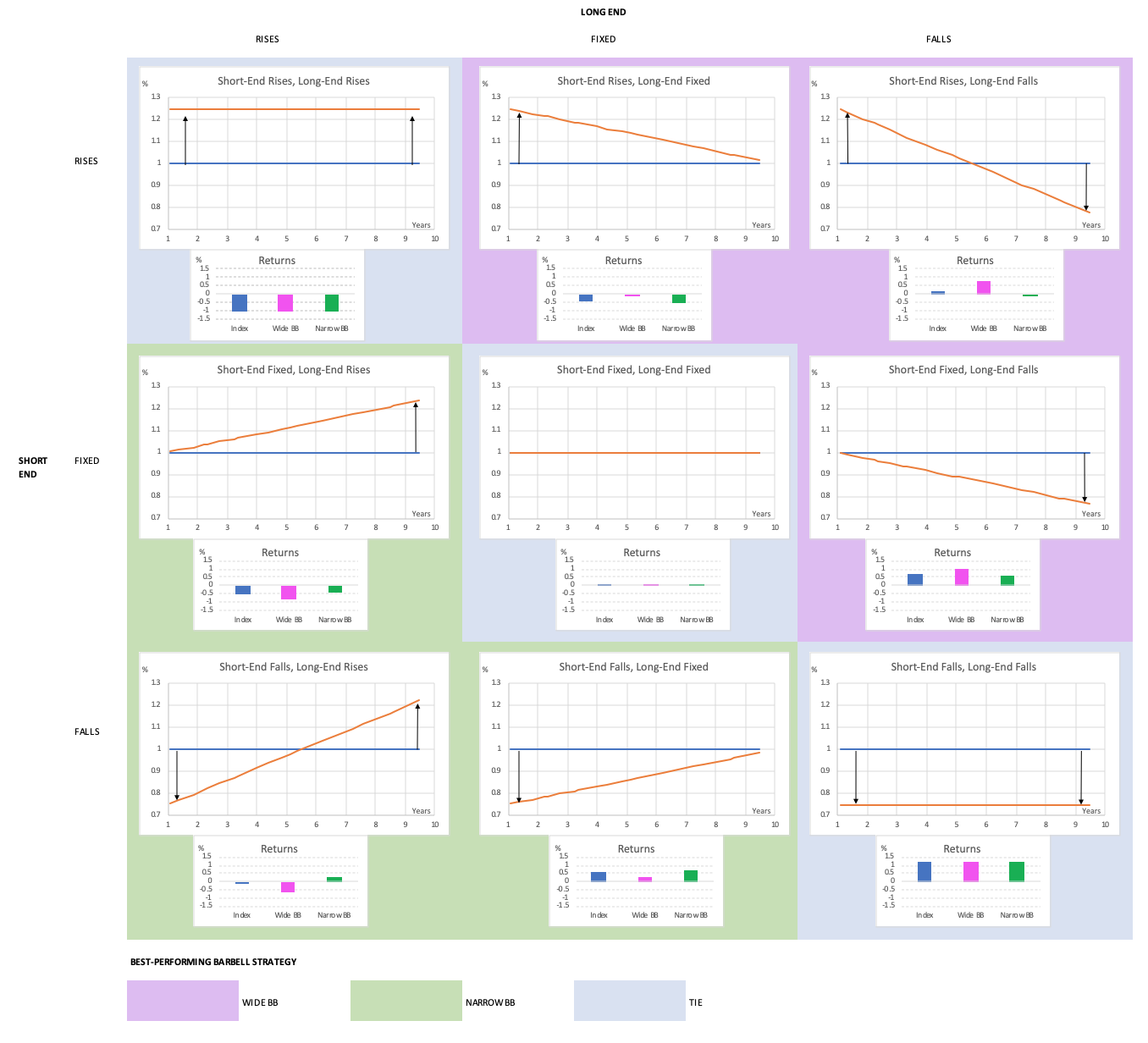

Returns Attribution Analysis

Carry and Roll-Down on a Yield Curve using R code

In calculating expected fixed income return, is expected currency

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

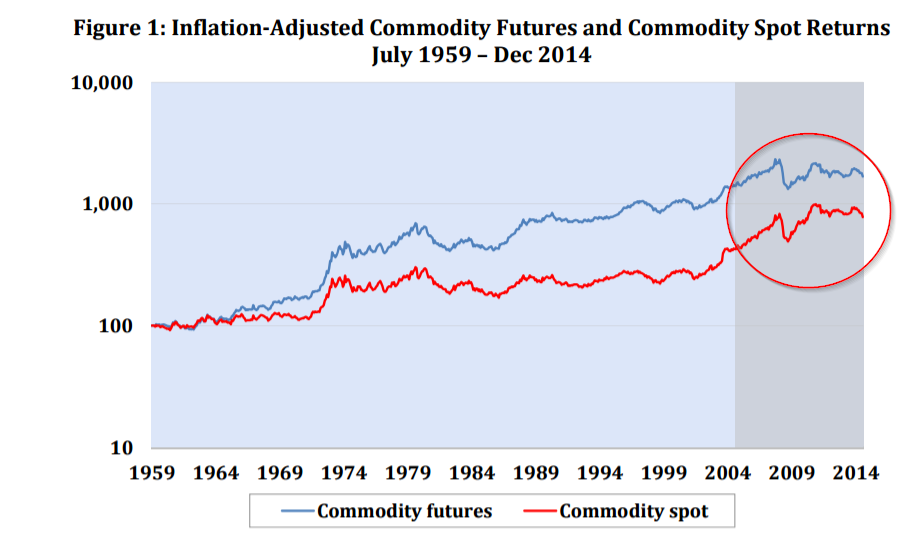

Commodity Futures Investing: complex, volatile, and fascinating

The basics of U.S. Treasury futures - CME Group

Contango - Wikipedia

Fixed income: Carry roll down (FRM T4-31)

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

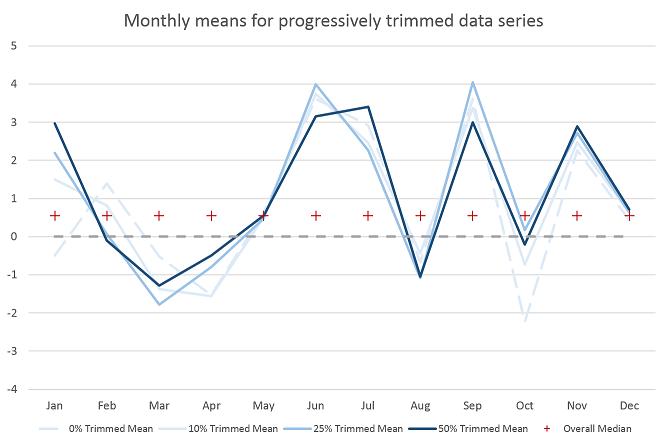

Riccardo Rossi on LinkedIn: Seasonality can be an input to trading decisions. In this post, I discuss…