Brazilian Investor Statement sets out a manifesto for a strong Brazilian Green Bonds Market Several important institutional investors (with BRL 1.8tn AUM) have signed the ‘Brazil Green Bonds Statement’, an initiative of the Climate Bonds Initiative (CBI), Principles for Responsible Investment (PRI) and SITAWI Finance for Good. The statement highlights the signatories desire to see the growth of a strong Brazilian green bonds market, sets out specific actions conducive to achieving this and aims to foster discussion and future issuance of these bonds in the local market.

Post Issuance Reporting in the Green Bond Market 2021

How New York plans to drive investment to its ambitious climate initiatives - Climate and Capital Media

The Landscape of Climate Exposure for Investors

:max_bytes(150000):strip_icc()/ESG-final-fc9c8799d2d34234a895cbab621c21ad.png)

What Is ESG Investing?

Global State of the Market Report 2022

Reports Climate Bonds Initiative

China Boosts Green Investment with Central Enterprises' Green Bonds Issuance - BNN Breaking

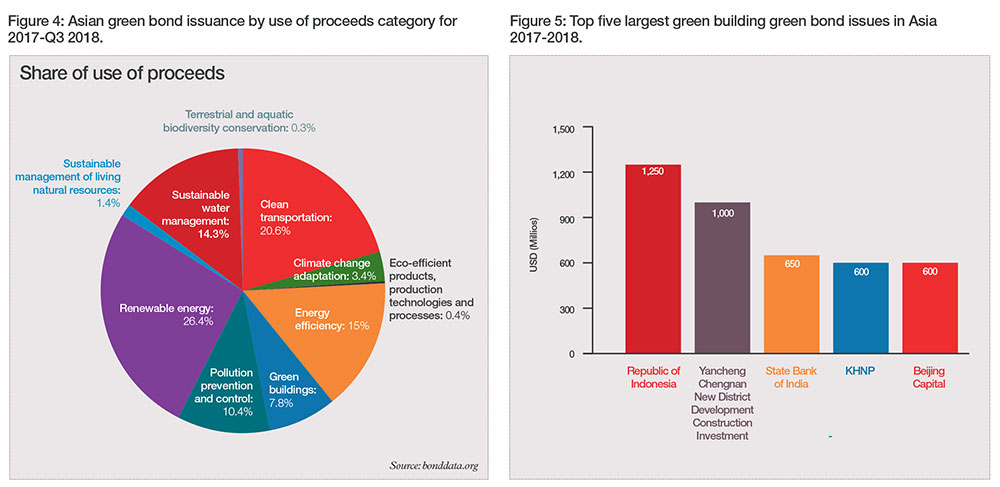

Opportunity awaits - Financing Asia's green buildings through green bonds :: Environmental Finance

Climate tech funding and financial services

Victoria Harling on LinkedIn: Thanks to MUFG and CBI for a great evening of insights shared by some of…

Appendix - Green Bond Links and Resources for Transit Agencies, Analysis of Green Bond Financing in the Public Transportation Industry

Climate Bonds on X: New in @ClimateBonds flagship State of the Market series. Nordic Sustainable Debt report 2020. In-depth analysis of Green, Social and Sustainability (GSS) investment in Sweden, Norway, Finland, Denmark