Negative Correlation - FundsNet

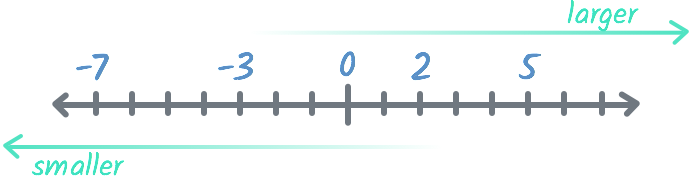

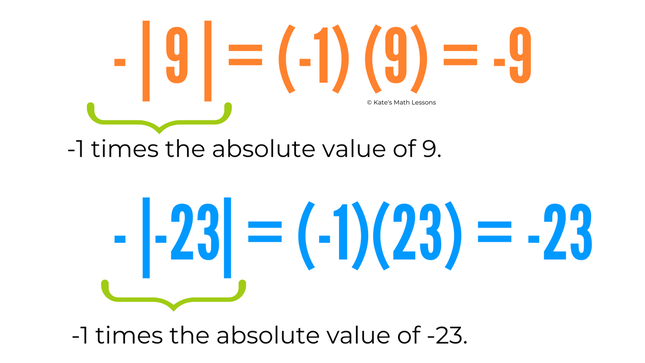

What is Negative Correlation? Negative correlation is a relationship between two variables where the variables have an inverse relationship. Basically, with negative correlation, as one variable increases, the other variable decreases. Negative correlation is often described by a correlation coefficient that is between 0 and -1. Two variables with a perfectly negative correlation would have View Article

Do mutual fund flows affect the French corporate bond market

Pension Reform, Financial Market Development, and Economic Growth

Negative Correlation - FundsNet

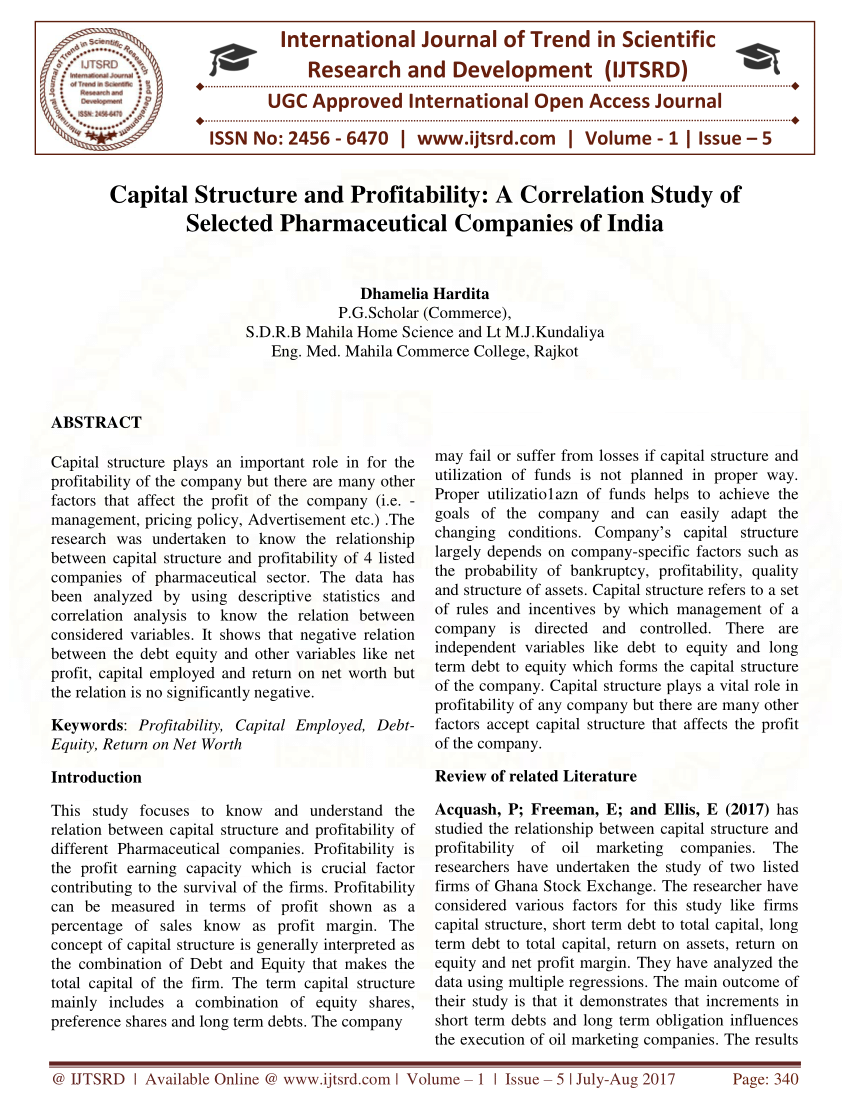

PDF) Capital Structure and Profitability: A Correlation Study of

A market bottom checklist update – Humble Student of the Markets

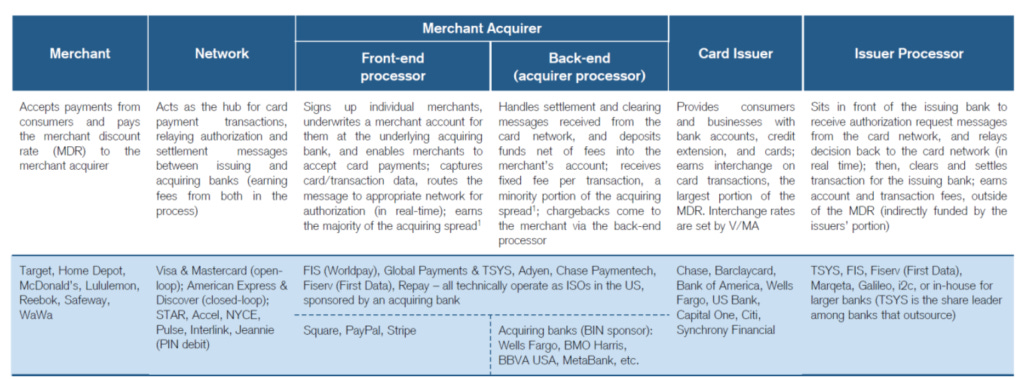

Adyen: The “Navy SEAL” Team of Payments - MBI Deep Dives

Stefan Feuchtinger on LinkedIn: #eua #euets

A MACROECONOMIC THEORY OF THE OPEN ECONOMY - Issuu

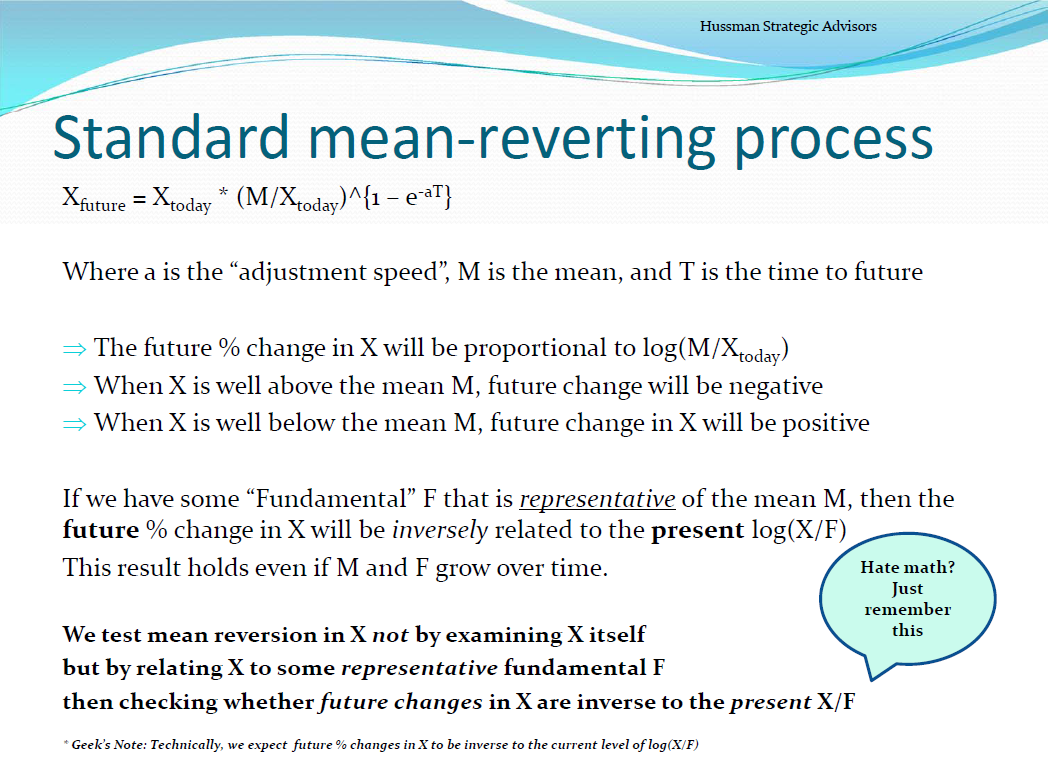

Hussman Funds - Weekly Market Comment: Two Point Three Sigmas Above the Norm - May 4, 2015

How to predict market tops and bottoms using the COT report.

Mutual funds: Stick to SIPs even if market remains volatile