Australia Green Finance State of the Market 2019

Australia green finance state of the market 2019 update calculates Australia cumulative green bond issuance to 30 June: AUD15.6bn, 10th in cumulative global country rankings, 3rd in the Asia-Pacific region behind China (USD91.5bn) and Japan (USD12.4bn). Annual 2018 issuance: AUD6.0bn (2017: AUD3.3bn), 9th in 2018 annual global country rankings H1 2019 issuance: AUD3.9bn.

Corporate bond market dysfunction during COVID-19 and lessons from the Fed's response

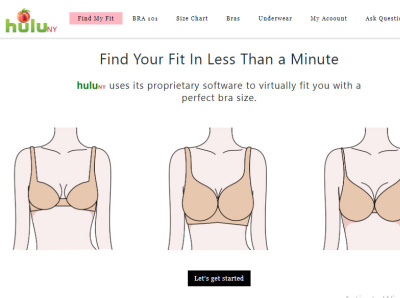

200 and counting – Global financial institutions committed to coal divestment has doubled in three years

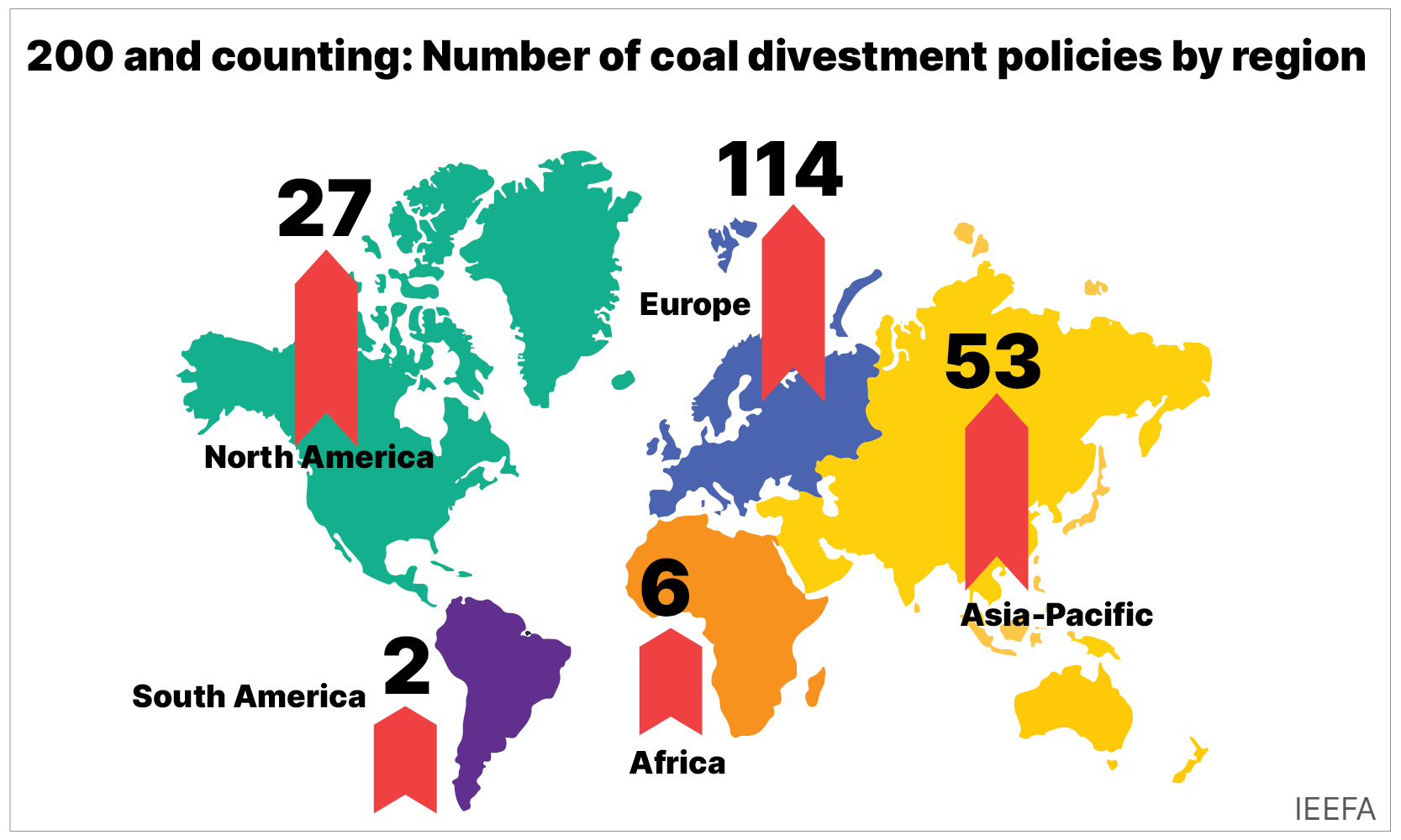

Sustainable Finance Q2 2023 Market Update

Australia Greenbonds Sotm-2019-Update August 270819 Final v1, PDF, Low Carbon Economy

Green finance presents multi-billion-dollar opportunity - Property Council Australia

2024 commercial real estate outlook

Australia to Develop Sustainable Finance Taxonomy, Labels for ESG Investment Products - ESG Today

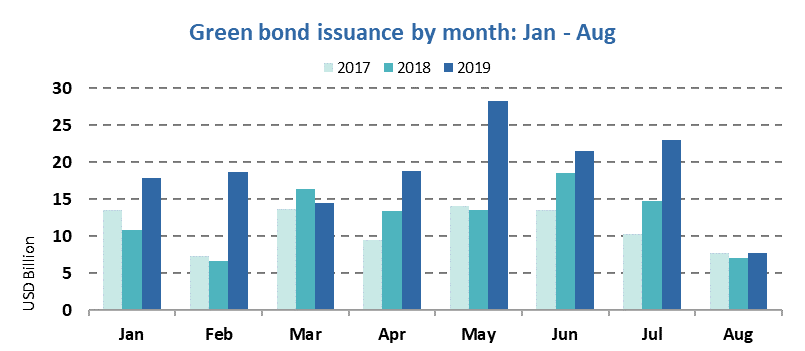

Market Blog #31 - 5/9/19: 2019 GB volume passes USD150bn in August: 1st Chinese Muni from Jiangxi Province: QIC's Certified GB for shopping centres: US Muni volume accelerates: E.ON, Owens Corning enter

How carbon markets should evolve to meet net-zero ambitions

Latin America & Caribbean: Green finance state of the market 2019 I América Latina y el Caribe: Estado del mercado de las finanzas verdes 2019 I América Latina e Caribe: Análise de

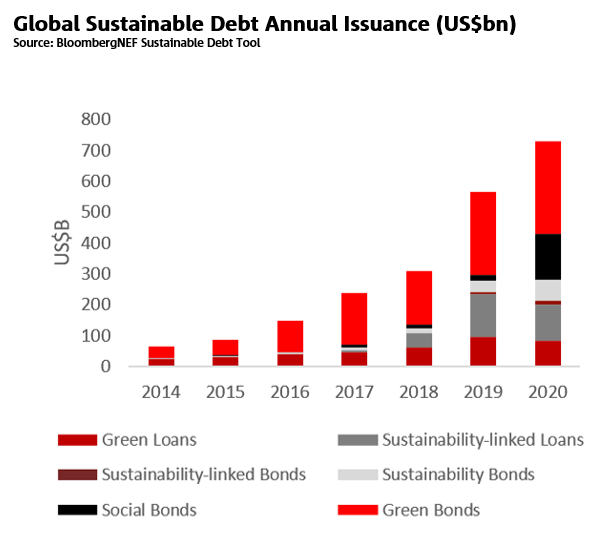

Sustainable Finance Update February 2021

Green and Sustainable Finance in Australia, Bulletin – September 2023

Financial Challenges 'Clobber' New York City's Office Landlords - The New York Times

Barnes Capital Green Hotels by premiere20 - Issuu

Australia: New GIIO Report Calls for Wave of 2020s Infrastructure Investment to Address Carbon Targets, Climate Impacts, Brown to Green Transition