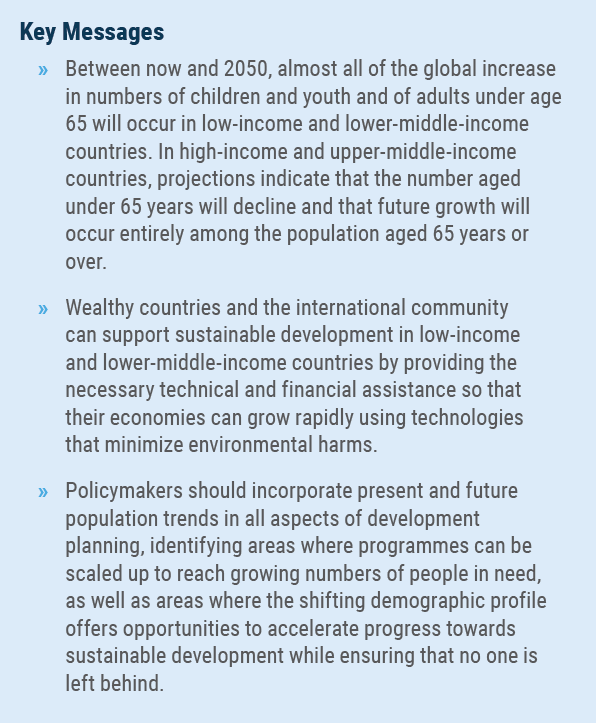

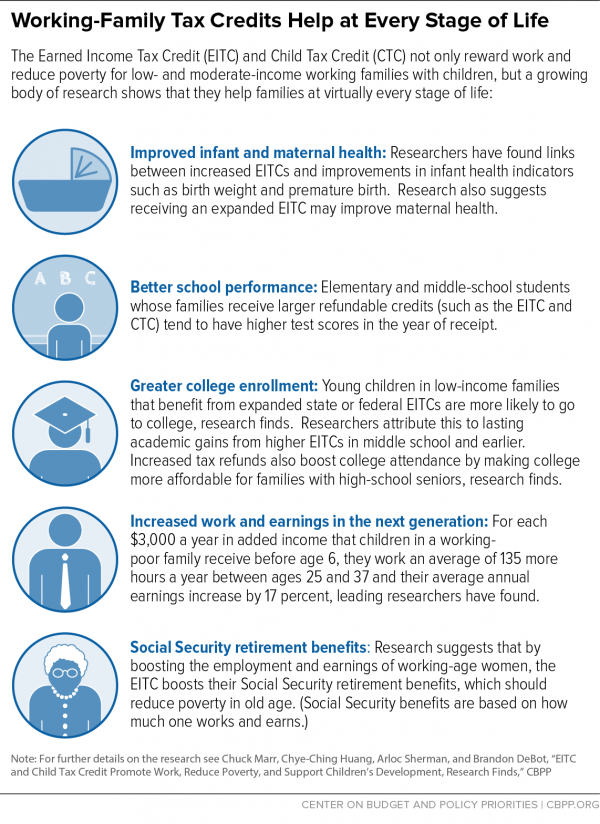

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

Can Couples Split Health Insurance Premium for Tax Benefit?

Taxes: Tax Implications of Whole Life Cost: What You Need to Know

Federal Tax Credit - FasterCapital

Income Tax Slabs in India: What You Need to Know

Resources For Individuals And Families - FasterCapital

Health Insurance Webster Chamber of Commerce

Preparing for the unexpected illness: a guide to critical illness

Reports and Research

Tips to deal with postpartum depression

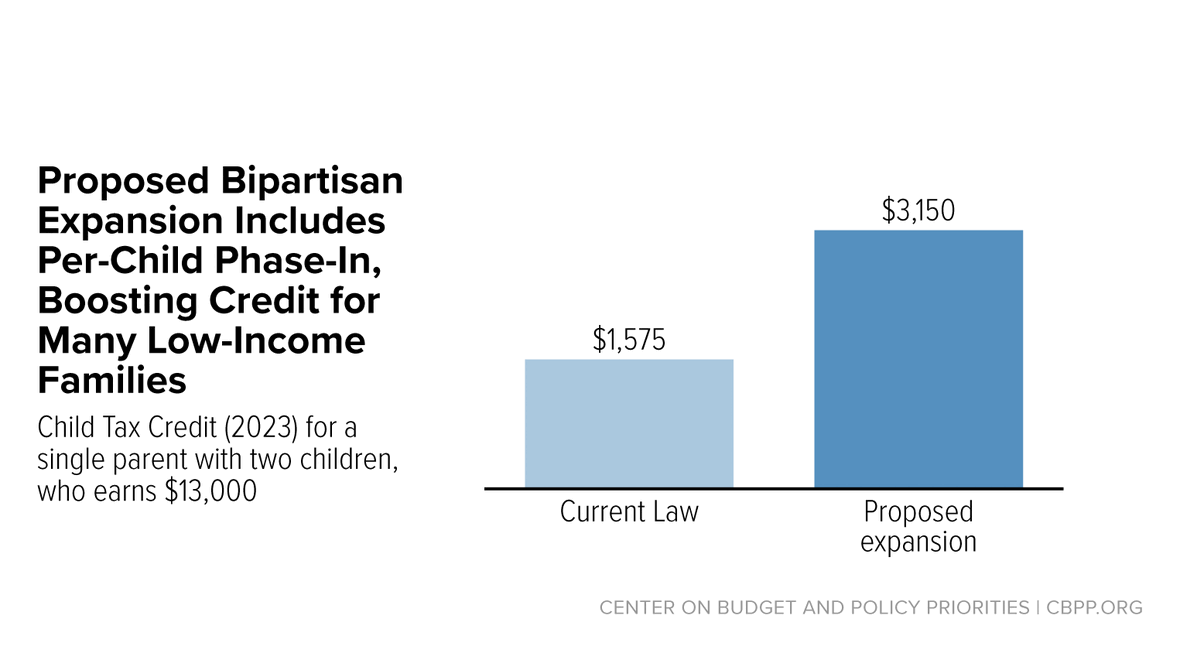

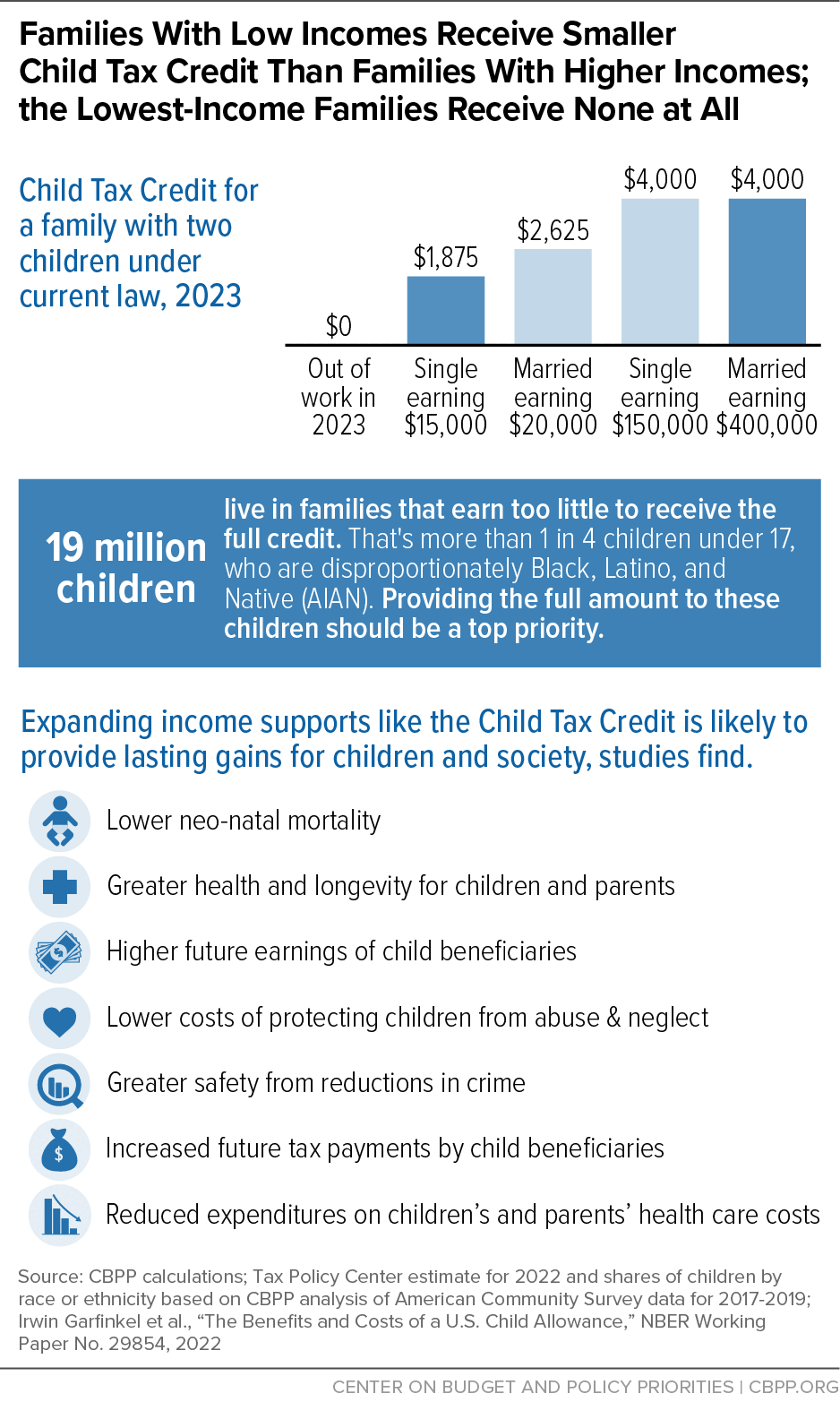

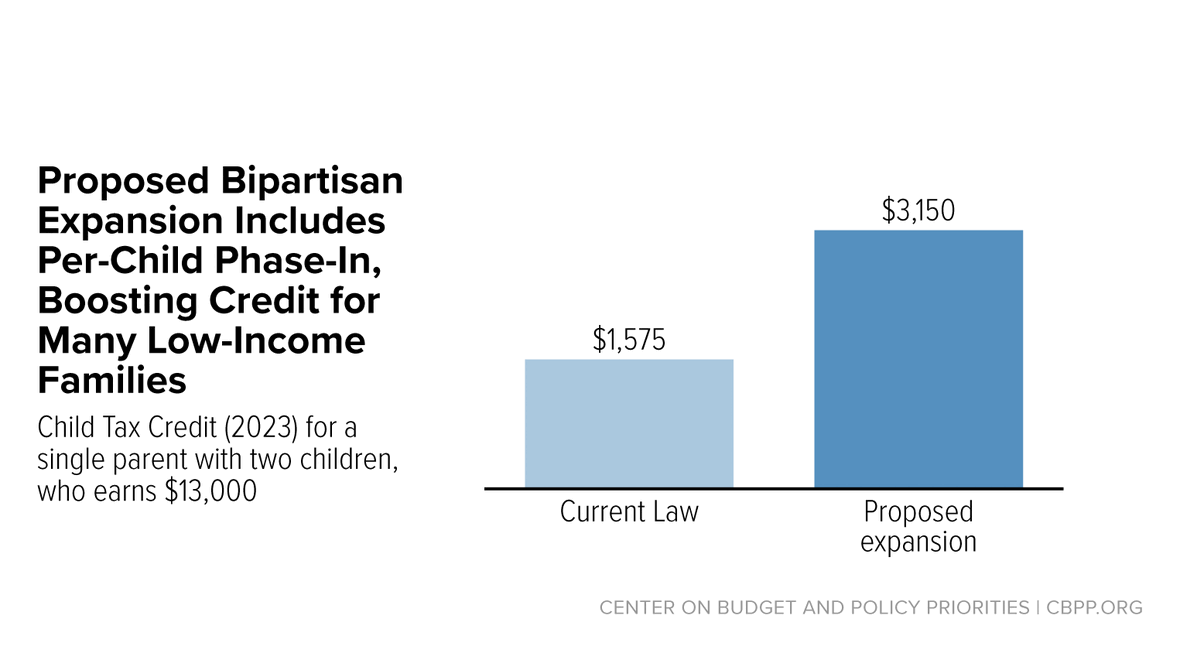

Top Tax Priority: Expanding the Child Tax Credit in Upcoming

Benefits of Expanding Child Tax Credit Outweigh Small Employment

Tax Credits for Individuals and Families