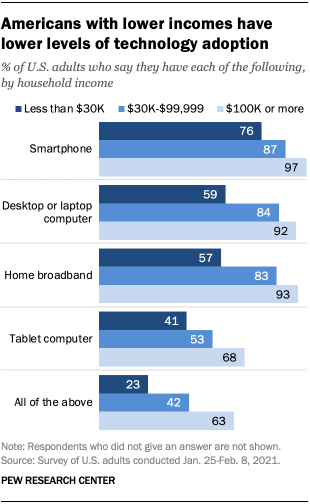

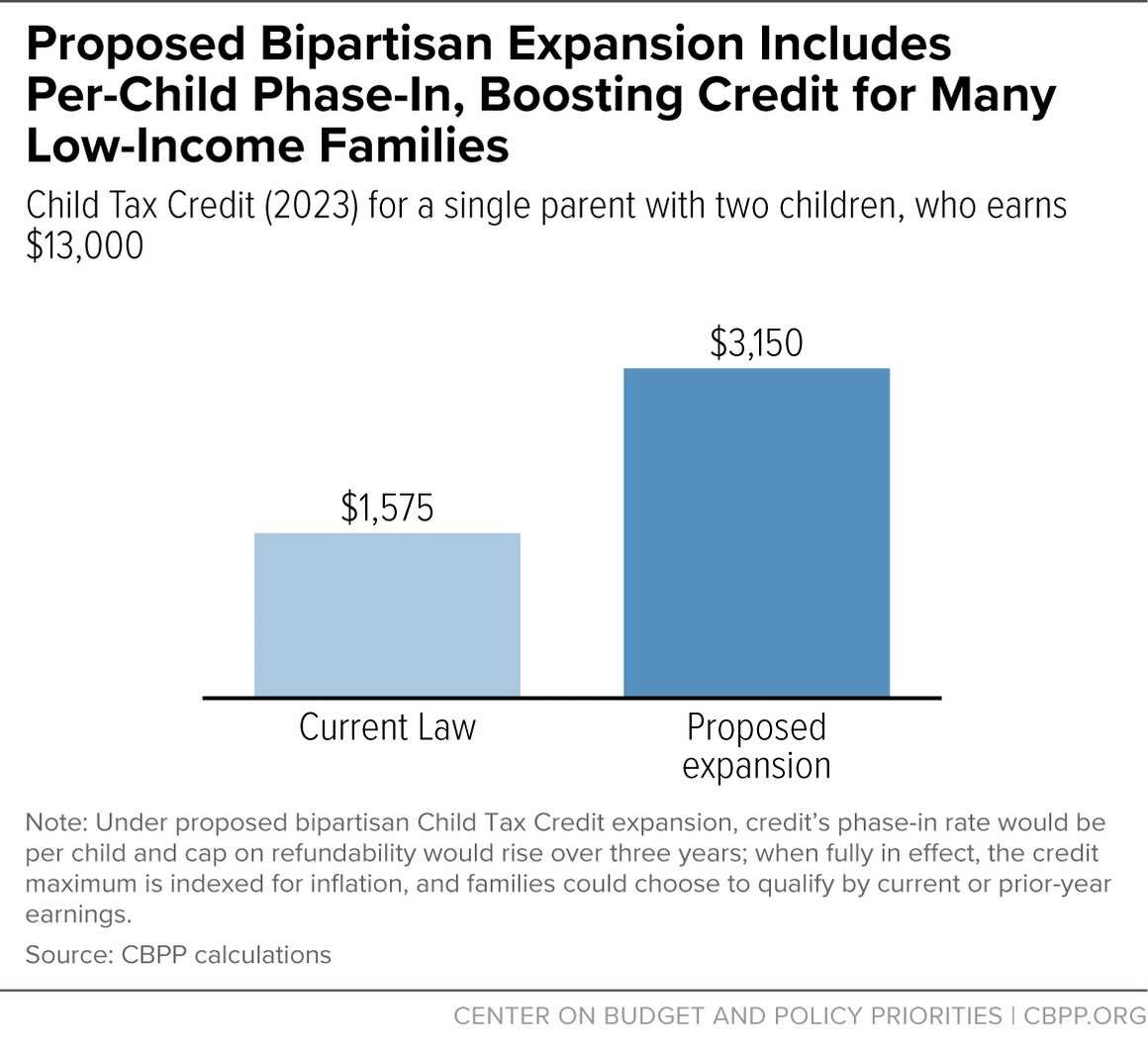

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

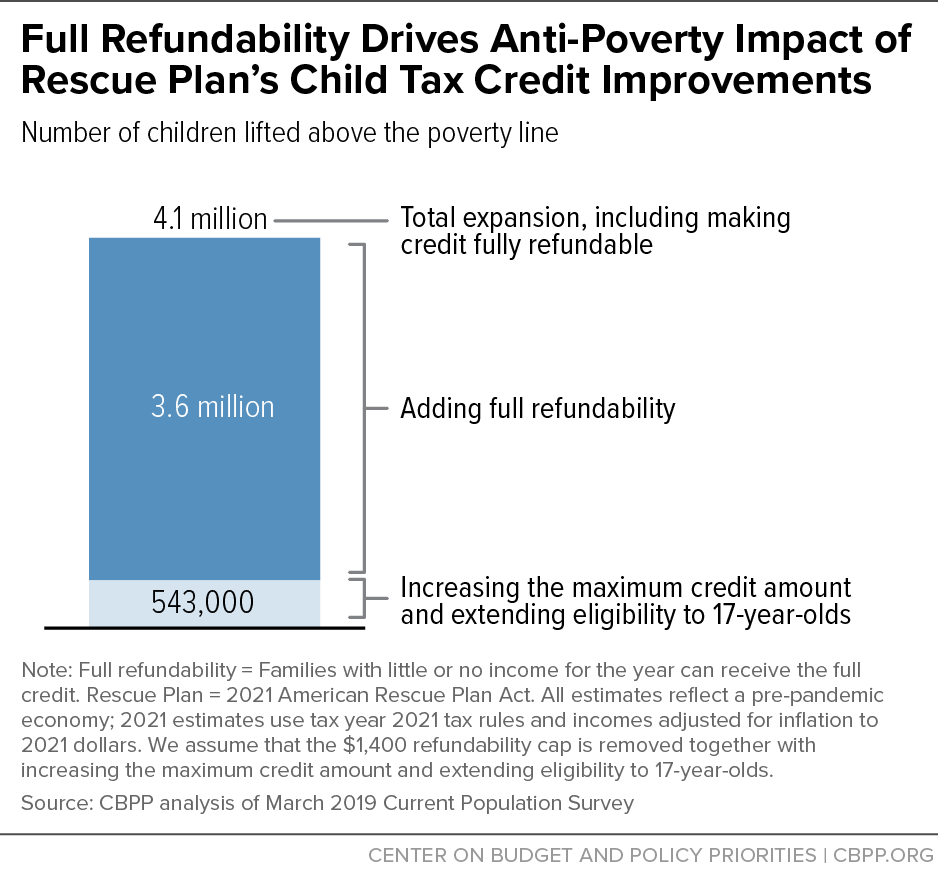

Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025.

Congress proposes child tax credit increase for 2024

Expansion on child tax credit

Center on Budget and Policy Priorities

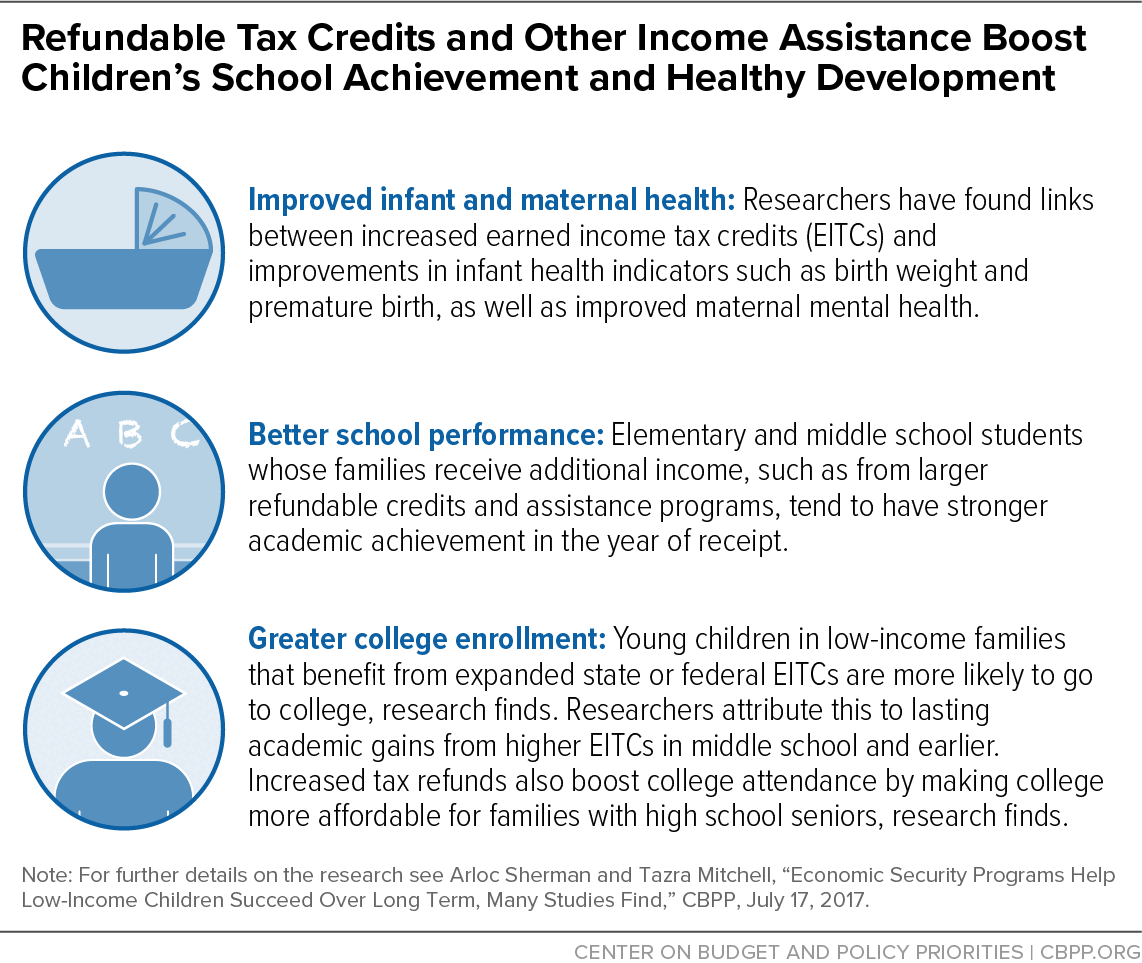

Income Support Associated With Improved Health Outcomes for

This week at CBPP, we focused on #FederalTaxes and the #economy.

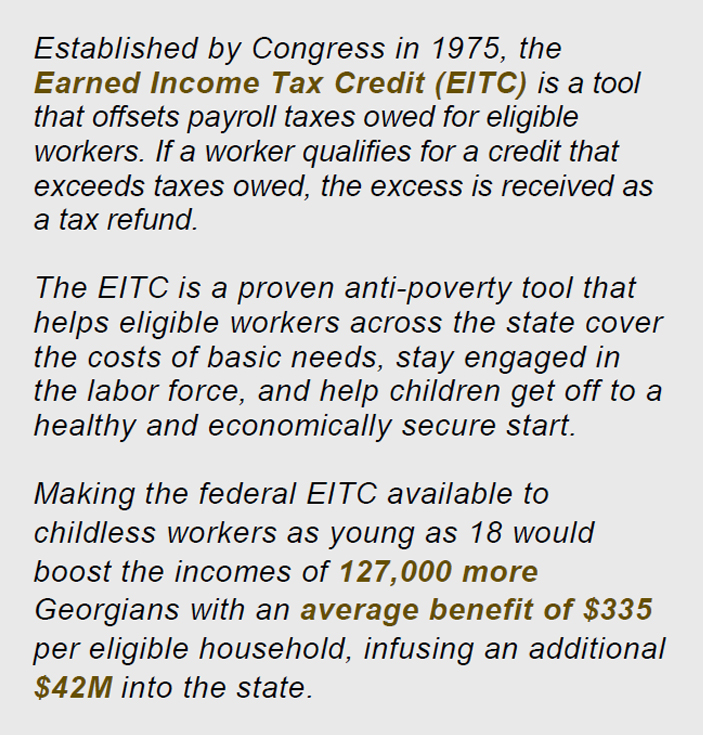

The Earned Income Tax Credit and Young Adult Workers - Georgia Budget and Policy Institute

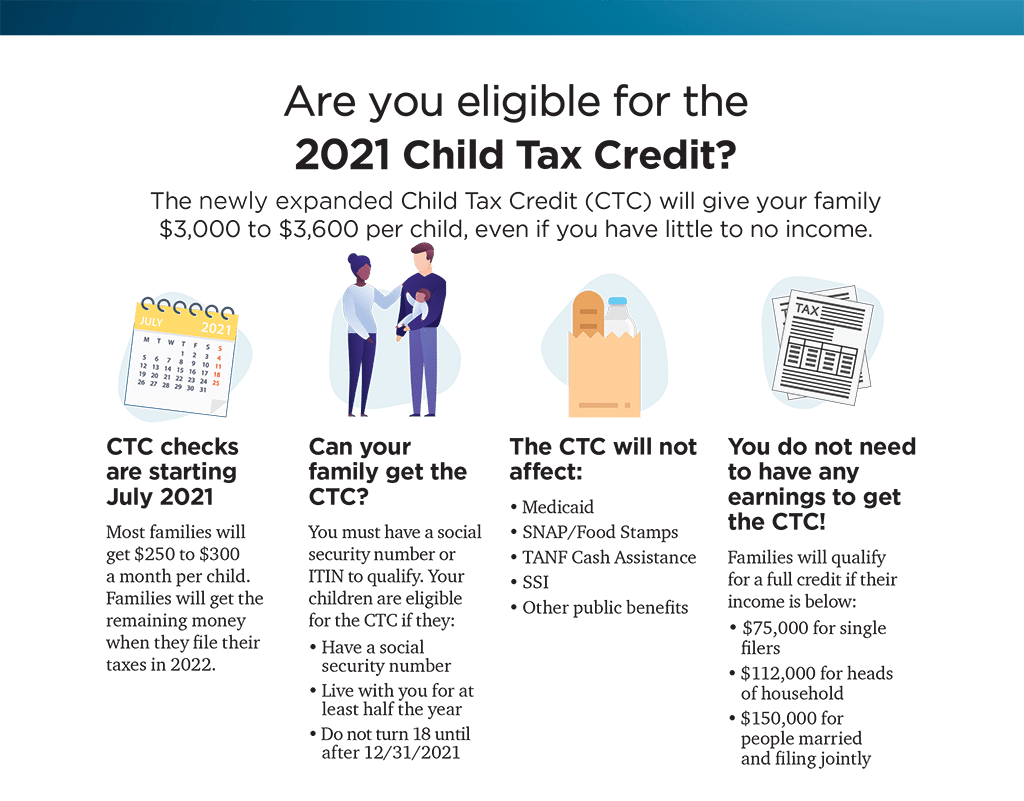

It's Not Too Late To Claim The 2021 Child Tax Credit, 46% OFF

Child Support Specialists

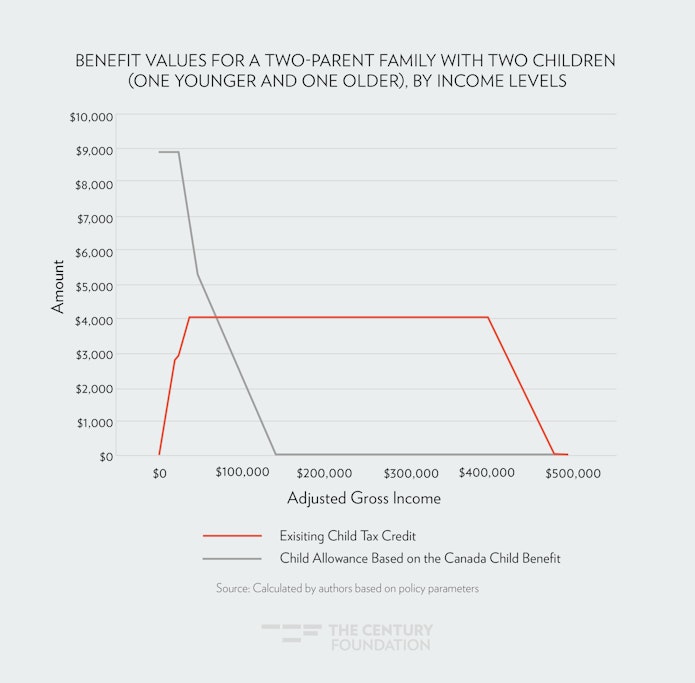

What a Child Allowance Like Canada's Would Do for Child Poverty in America

Lisa Jansen Thompson posted on LinkedIn

Recovery Package Should Permanently Include Families With Low

The Impact of Families with No Income on an Expanded Child Tax Credit - Jain Family Institute

House passes bill to help millions, but Senate GOP doesn't want Biden to 'look good

NETWORK Applauds Bipartisan Expansion of the Child Tax Credit, Urges Immediate Passage - NETWORK Lobby

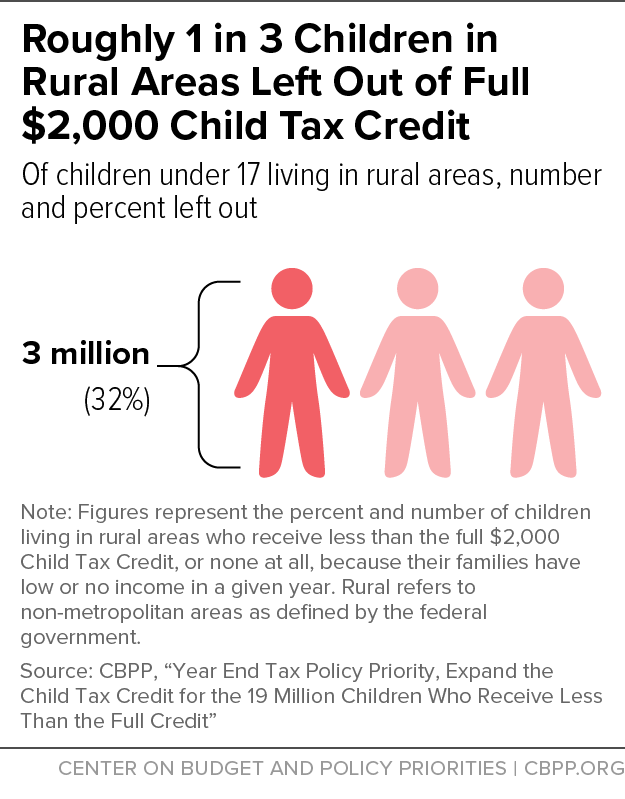

Child Tax Credit Expansion Is Especially Important to Rural Families

:max_bytes(150000):strip_icc()/laying-yoga-mat-GettyImages-177247279-c8b719bba48a4abead72acaee50fc495.jpg)