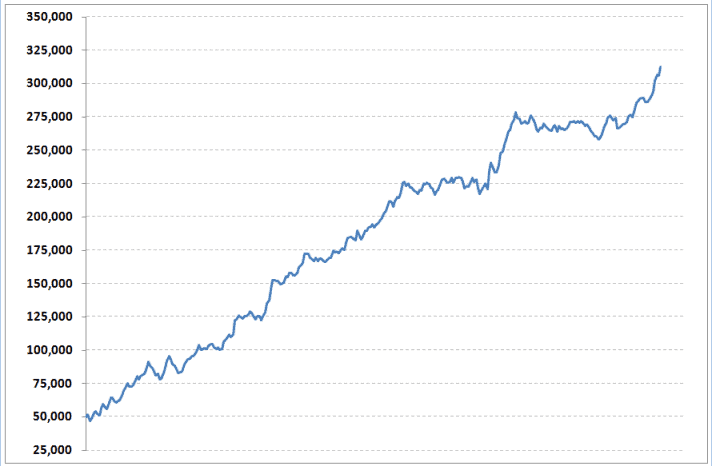

Optimize Your Portfolio Using Normal Distribution

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-01-7b5b43d1e34d44229a3bd4c02816716c.jpg)

Normal or bell curve distribution can be used in portfolio theory to help portfolio managers maximize return and minimize risk.

:max_bytes(150000):strip_icc()/GettyImages-1500412812-3a5a2a32be064457938b41f9481d1815.jpg)

Shobhit Seth

Tips For A Diversified Portfolio The Motley Fool, 56% OFF

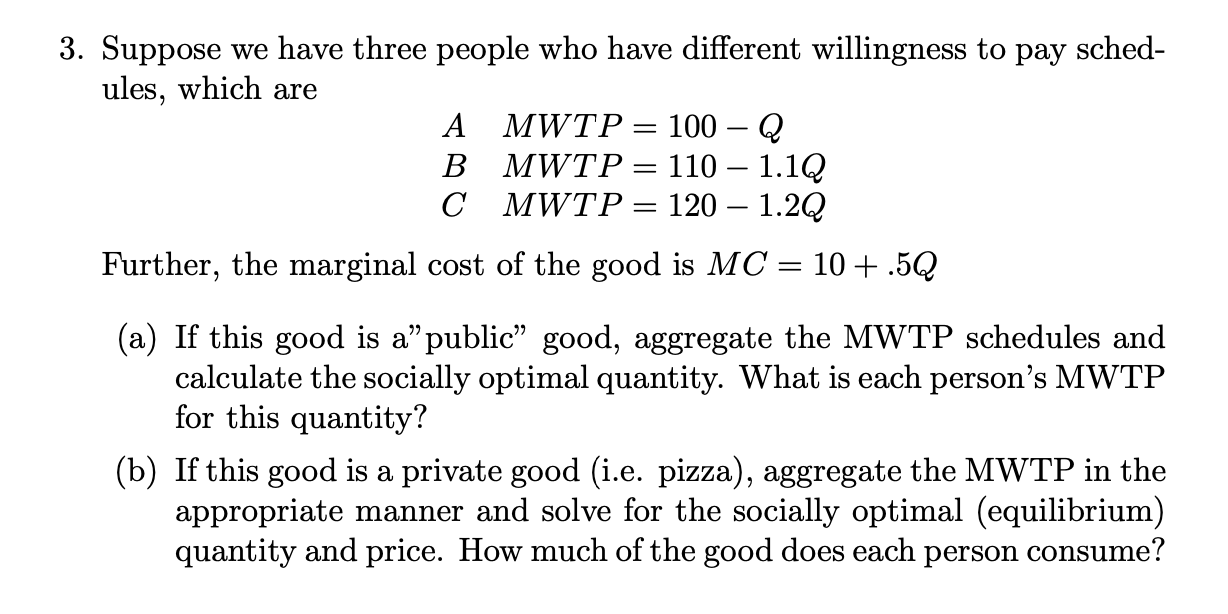

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

CLA2-Preshit-Dwivedi.docx - Running head: Portfolio of Apple JP Morgan and McDonald's 1 Preshit Dwivedi Westcliff University BUS 550: Financial

Normal and Lognormal, PDF, Probability Distribution

Normal Distribution - What It Is, Properties, Uses, and Formula, PDF, Normal Distribution

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

:max_bytes(150000):strip_icc()/skewness-Final-e6e1970b817443f897a4a65d2c5b92d1.jpg)

Optimize Your Portfolio Using Normal Distribution

Decision Model in Marketing, PDF, Regression Analysis

CLA2-Preshit-Dwivedi.docx - Running head: Portfolio of Apple JP Morgan and McDonald's 1 Preshit Dwivedi Westcliff University BUS 550: Financial

Normal and Lognormal, PDF, Probability Distribution

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-04-a92fef9458844ea0889ea7db57bc0adb.jpg)

Optimize Your Portfolio Using Normal Distribution

Article 1 Optimize Your Portfolio Using Normal Distribution References, PDF, Normal Distribution