Bobl spread is 53.1bp, we are 3 months away from mar18 delivery, and a client blasts “what do you see as carry and roll for OE asw?”. Here are my notes on the mechanics of the calculati…

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

/thmb/t6uPsyWkraC2sbbet4Yidajt

CFA Level 3 Fixed Income: Carry Trade with Bond Futures

Valuation of Forward Contracts - Lesson

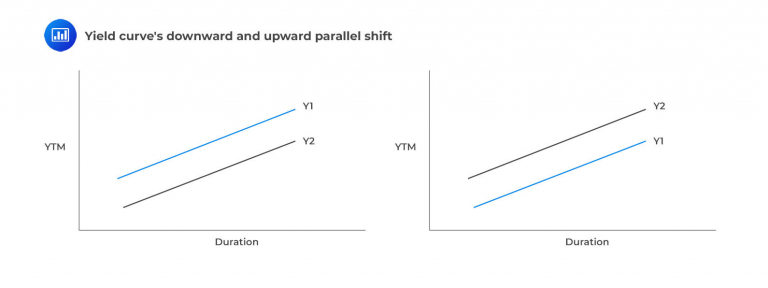

Yield Curve Strategies - CFA, FRM, and Actuarial Exams Study Notes

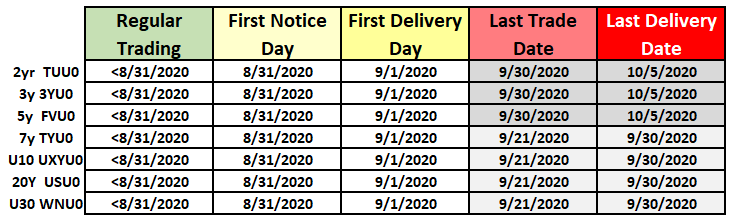

Understanding Treasury Futures Roll Spreads, Futures Brokers

Asset swap - Wikipedia

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

CFA Level 3 Fixed Income: Carry Trade with Bond Futures

Frontiers Deep treasury management for banks

Quantitative Tightening Step-by-Step - Joseph Wang

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources