Can you claim tax benefit for tax paid on insurance premium?, ET RISE MSME DAY

Section 80C and 80D of Income-tax Act entitles specified taxpayers to claim deductions for the entire amount paid to the insurance company for specified insurance schemes.

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

Are Health Insurance Premiums Tax-Deductible?

Publication 974 (2023), Premium Tax Credit (PTC)

How Can I Pay My Life Insurance With Pre-Tax Dollars Rather Than After-Tax Dollars?

5 ways to save tax

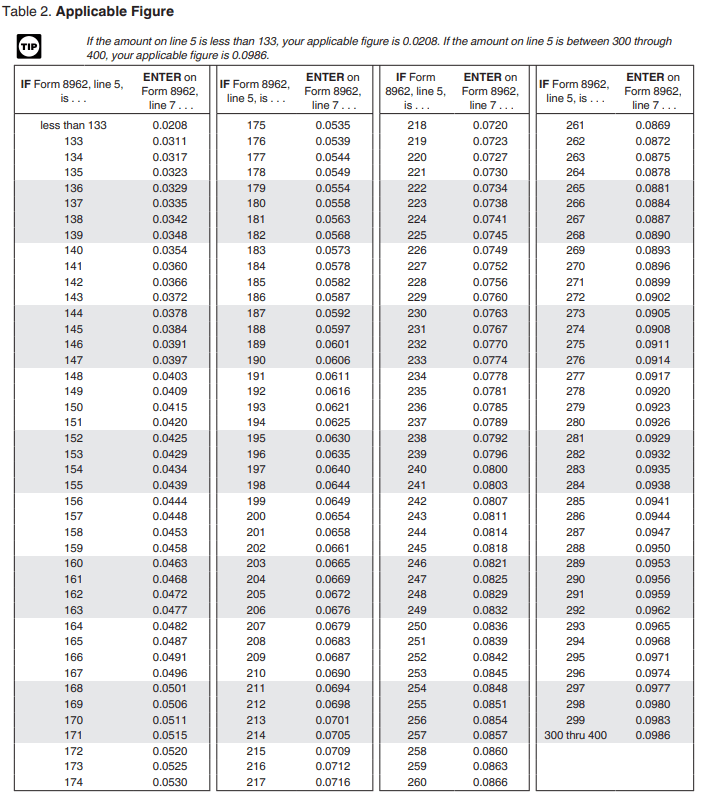

Premium Tax Credits

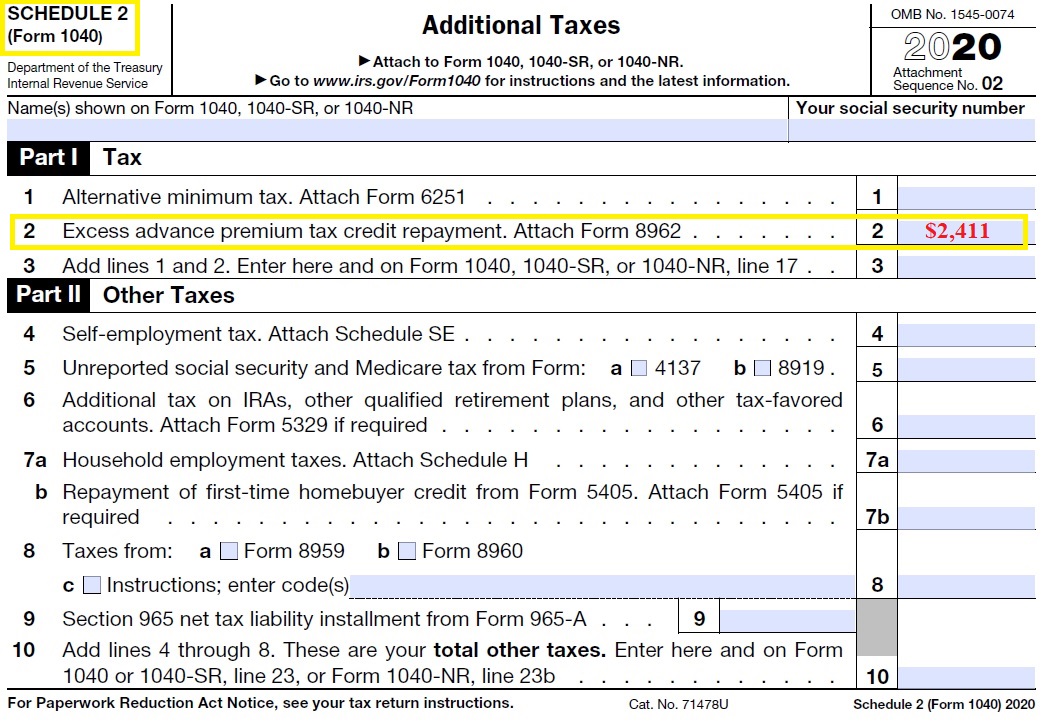

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

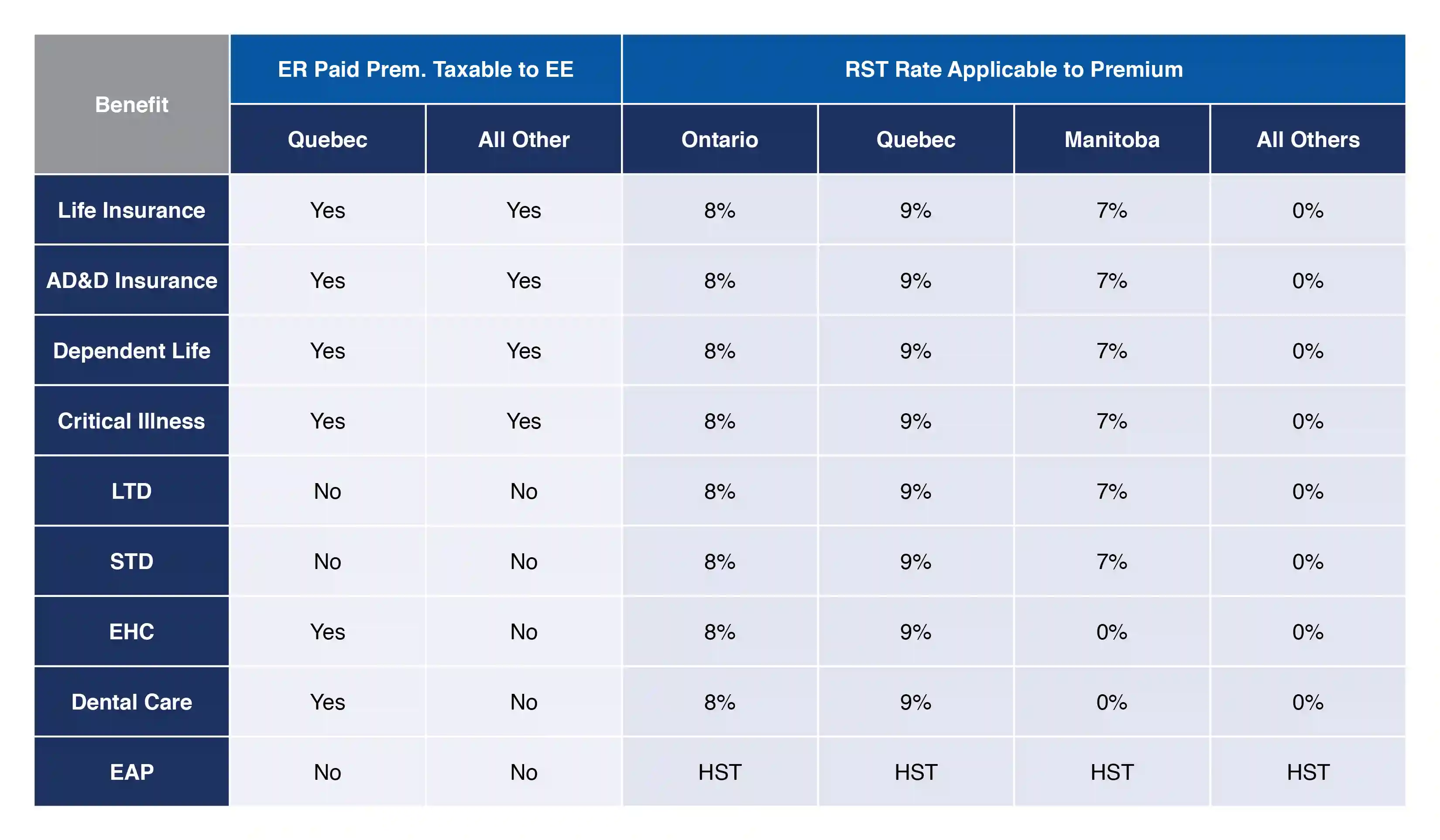

Are Life Insurance Premiums Tax-Deductible In Canada?

Taxation Group Force

Are Life Insurance Premiums Tax-Deductible In Canada?

EI Sickness Benefit

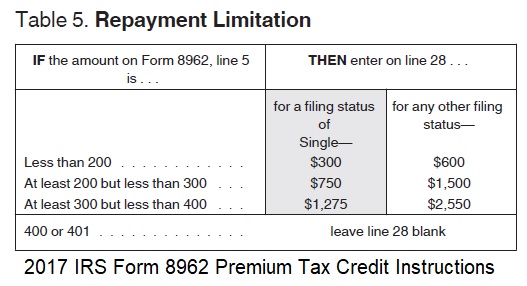

IRS limits on ACA Advance Premium Tax Credit repayment

What are Tax Benefits for MSME?

Is Life Insurance Tax Deductible in Canada? - Dundas Life

Premium Tax Credit vs. Self-Employment Health Insurance Deduction : r/taxhelp

Health Insurance Tax Benefits For Small-Business Owners