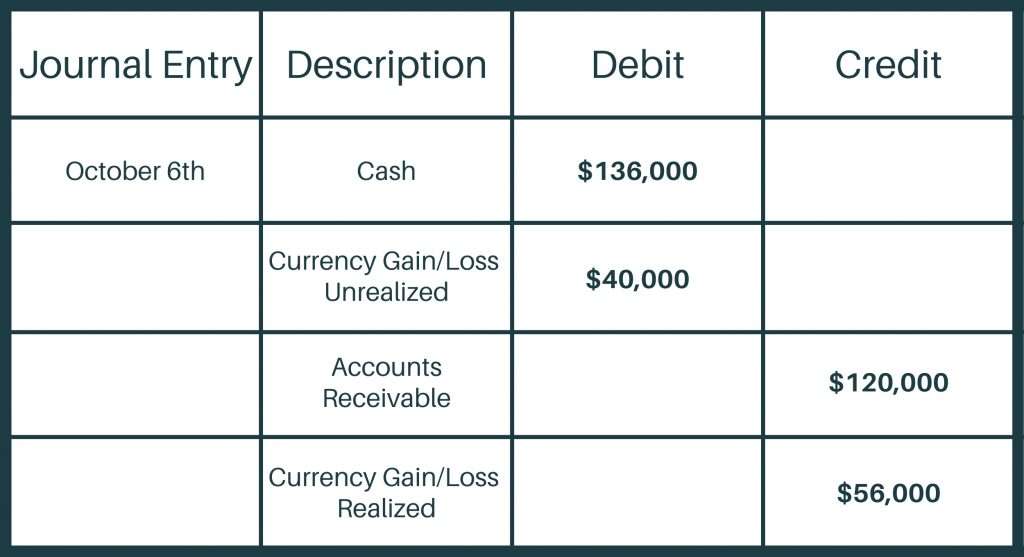

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

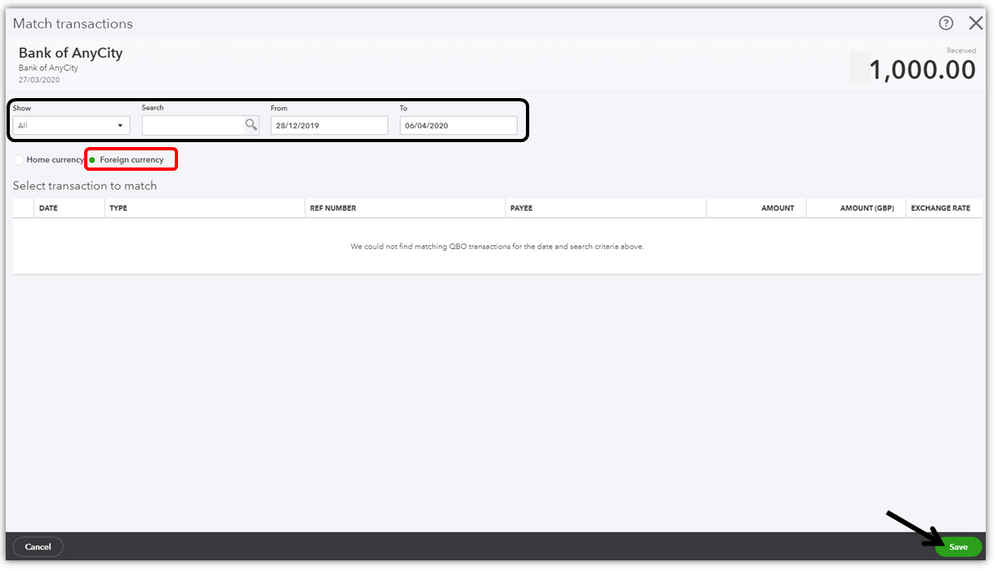

Work with Journal Entries with Foreign Currency

Foreign Currency Translation: International Accounting Basics

foreign currency - How to record foreign currency payment? - Treezsoft Blog

Foreign currency invoices and bills – Help Center

Foreign Currency Transaction w/ Journal Entries (FAR MCQ)

Foreign Currency Translation: Definition, Process and Examples

What types of journal entries are tested on the CPA exam? - Universal CPA Review

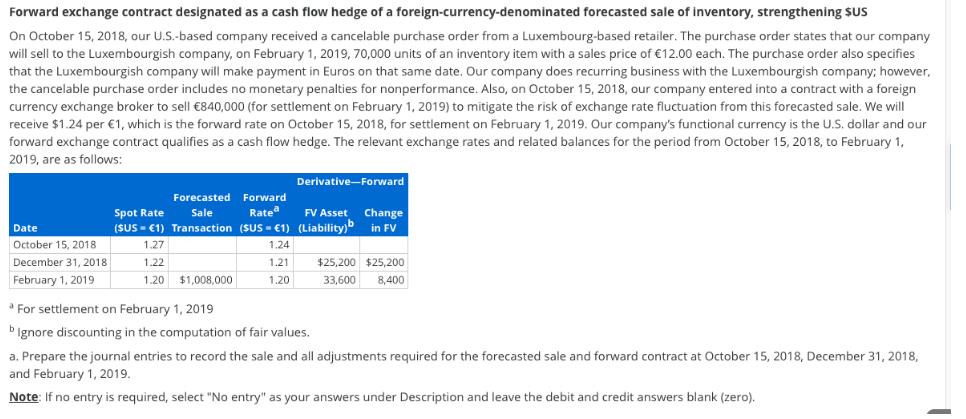

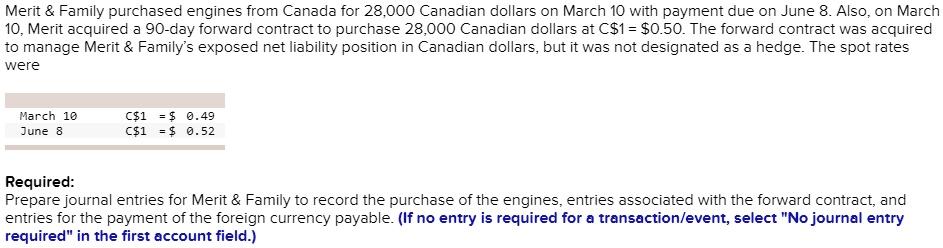

Solved] Forward exchange contract designated as a

Record foreign currency payment against the invoice raised

Foreign Currency Transaction Bookkeeping

Journal Entries in Accounting with Examples - GeeksforGeeks

4.4 Preparing Journal Entries – Financial Accounting

SOLVED: Journal entries for an account receivable denominated in Euros (USD weakens). Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment

SOLVED: Record the foreign purchase of the engines. Record the entry for the 90-day forward exchange contract signed to receive Canadian dollars. Record the entry to revalue the foreign currency receivable to