Let’s say you’ve known for years that you are inheriting your father’s home when he dies. Hopefully, you also know that he has a will that indicates clearly that the house will go to you.

Allegheny County School District Appealing Property Assessment

Parent PLUS Borrowers: The Hidden Casualties of the Student Debt Crisis

What to know before co-owning a home with a parent or child

Our Family, Ross Law

2nd district primary candidates take on state gas tax and term limits, Regional

What to Know Before Buying a Home With Your Parents - The New York Times

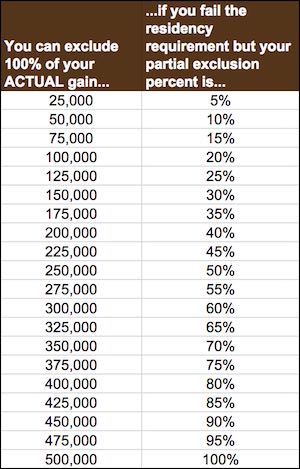

Avoiding capital gains tax on real estate: how the home sale exclusion works

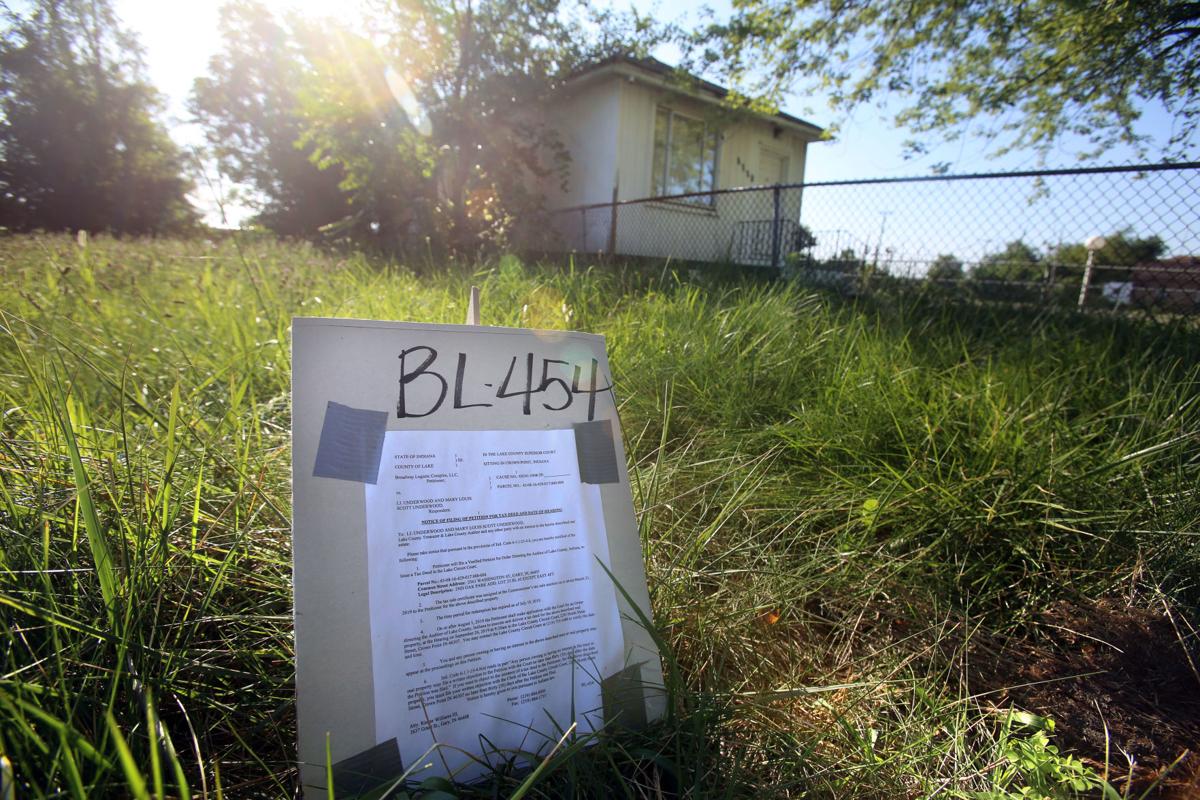

Tax sale 'churner' law won't be implemented in Lake County

Flat Fee For Sale by Owner Program - GRL Law

Oren Ross, Esq., MBA on LinkedIn: #estateplanning #law #finance #taxes

[Ross MD PhD, Theodora, Mukherjee, Siddhartha] on . *FREE* shipping on qualifying offers. A Cancer in the Family: Take Control of Your

A Cancer in the Family: Take Control of Your Genetic Inheritance

Financial Advisor Jason Ross in Evans, GA 30809

Four Ways to Pass Your Home to Your Children Tax-Free