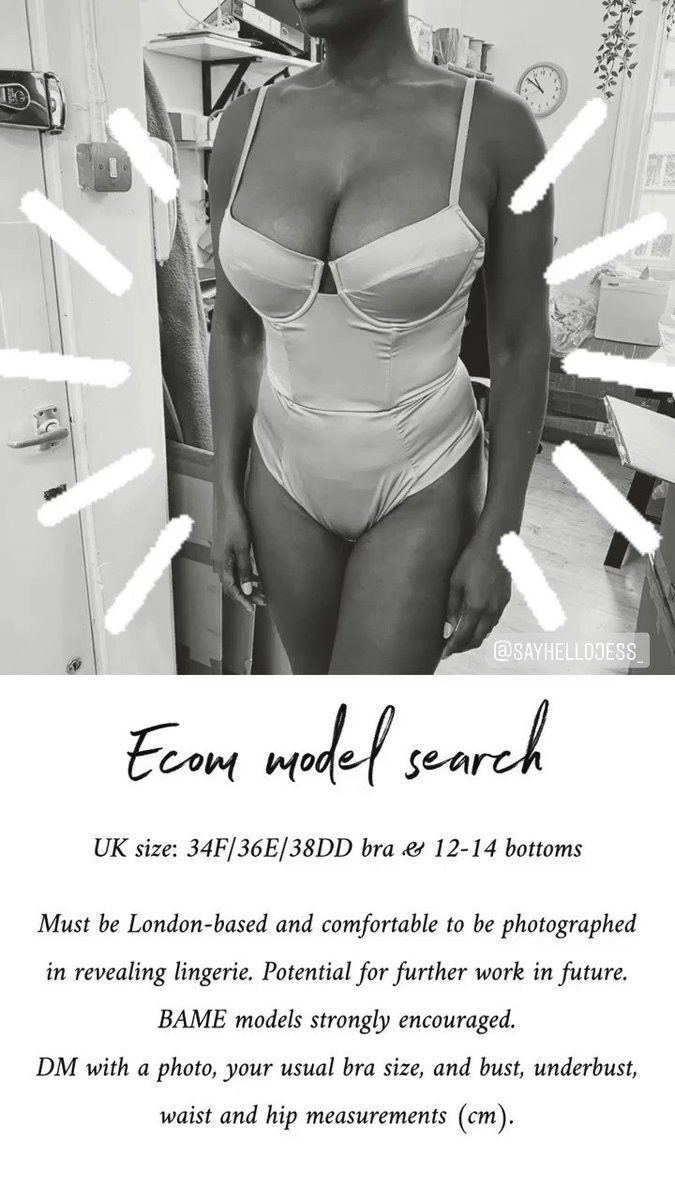

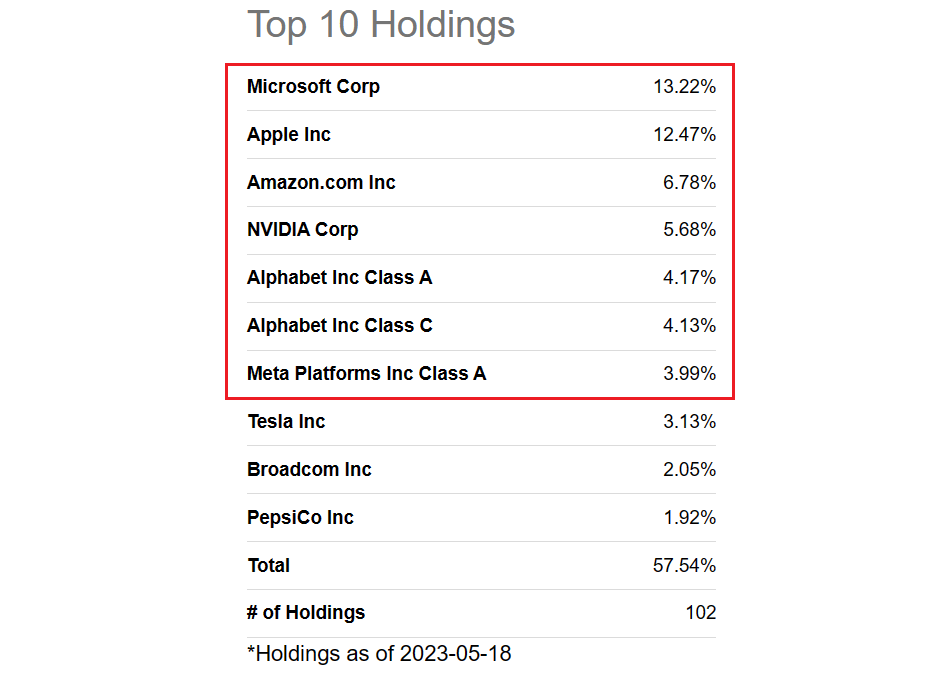

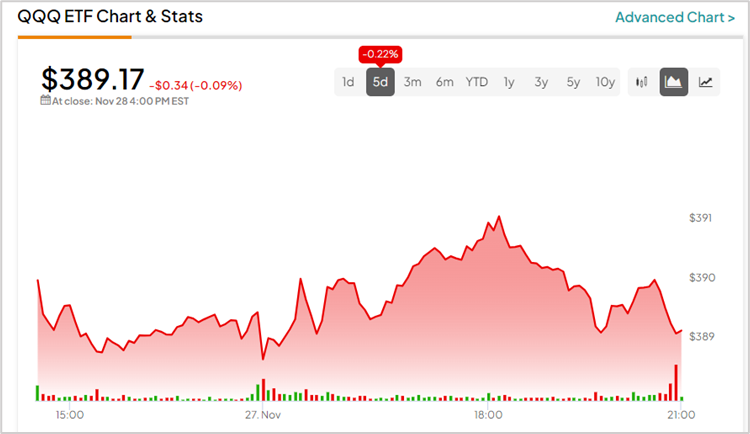

Fund overlap: the hidden risk in your portfolio

Fund overlap is a hidden risk in your portfolio. You may own different funds, but if those funds all own the same stocks then you're not diversified.

Is it advisable to have two small cap mutual funds in a portfolio? - Quora

Fund Overlap Risk: Minimizing Redundancy in Investment Portfolios - FasterCapital

ETF Insider - ETF & Mutual Fund Overlap and Correlation Tool

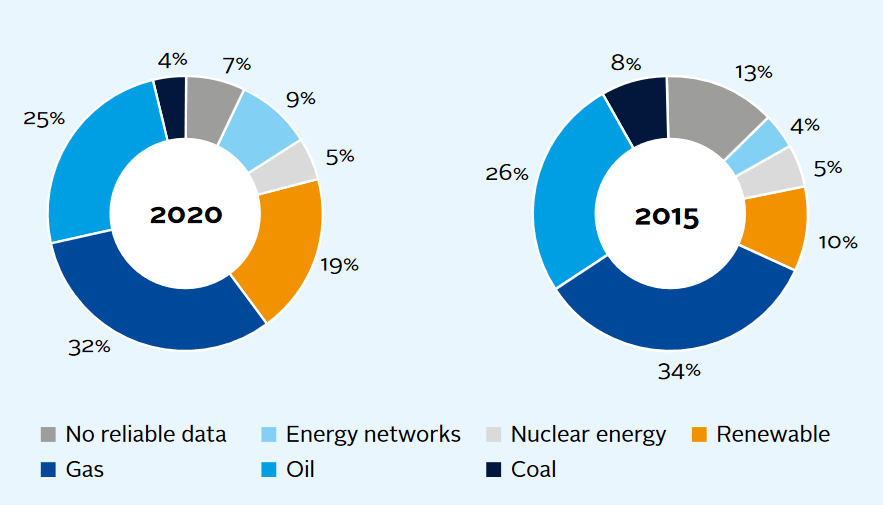

An introduction to responsible investment: climate metrics, Introductory guide

The Art of Balancing: Evaluating and Adjusting Mutual Fund Overlap in Your Portfolio - Hennion & Walsh Trending

Mutual Fund Portfolio Overlap, Mutual Funds, Investment Planning

Donald Cummings, Author at Blue Haven Capital

6 Investment Risk Management Strategies

How Private Equity Works: A Brief Explainer

:max_bytes(150000):strip_icc()/diversification.asp-FINAL-b2f2cb15557b4223a653c1389389bc92.png)

What Is Diversification? Definition as Investing Strategy

Private Equity vs. Hedge Funds

How to Review your Mutual Fund Portfolio?

:max_bytes(150000):strip_icc()/fundsoffunds.asp-Final-4449fedbe6cf48e29932f9bdc80c59f5.png)

Fund of Funds (FOF) Explained: How It Works, Pro & Cons, Example

Fund Overlap Risk: Minimizing Redundancy in Investment Portfolios - FasterCapital

Fund Overlap AwesomeFinTech Blog